Somerset, NJ, Nissan Parts Distribution Center Employees File Petition for Vote to Kick Out UAW Union

UAW union officials imposed forced-dues contracts on Nissan employees

Mark Mix wades into New Jersey to point out that the union bosses of the state care about one thing — padding their pockets with money from the taxpayers, come hell, high water or bankruptcy.

Pointing out that New Jersey’s budget is “in shambles,” Governor Chris Christie made national news last month pushing for $2 billion in spending cuts just for the remaining four-and-a-half months of fiscal year 2010.

Why isn’t he following in the footsteps of previous governors who raised taxes and/or tinkered with fiscal timetables when faced with large budget deficits? “The old ways of doing business have not served the people well,” explained Christie.

He is right about that. The Garden State now stands before a fiscal abyss not primarily because of the recent national recession, but because New Jersey’s heavily unionized public sector has systematically sucked resources and vitality out of the state’s beleaguered private-sector employees and businesses.

For example, from 2003 to 2008, even as the national economy boomed, the state’s private-sector employment grew by a total of just 1.5 percent, roughly a quarter of the national average. Meanwhile, state and local government jobs (more than two-thirds of them under union monopoly-bargaining control) soared by 5.9 percent, nearly four times private-sector job growth.

And it’s not just the wages, salaries and benefits of active unionized government employees that are growing far more than those of private-sector employees. A large and rapidly growing share of public-employee compensation billed to taxpayers and firms comes from outsized public pension and retirement-health benefits.

Union negotiators with monopoly-bargaining privileges, as well as Big Labor lobbyists and the politicians who do their bidding, have over the years established policies that encourage healthy public employees to retire while they are still in their early fifties with pension and health benefits worth $100,000 or more a year.

No wonder New Jersey’s property taxes in 2009 were an average of nearly $7,300, the highest in the nation and more than 70 percent higher than they had been just a decade earlier. No wonder the nonpartisan Tax Foundation ranked the state’s business tax climate as the worst in the nation both this year and last year. No wonder Chief Executive last year ranked New Jersey a dismal 48th out of the 50 states for doing business.

Unless your elected officials can resolve to curtail sharply the growth in the cost to taxpayers of unionized government employees’ and retirees’ compensation, the state faces a very bleak economic future and possibly even bankruptcy.

And at this writing it is still unclear whether the Big Labor-dominated legislature will adopt even the tentative public spending reforms that are now on the table. And union lobbyists are going to pull out all the stops to prevent those reforms from happening.

By all appearances, government union bosses do not care whether or not your state goes under.

Their intransigence makes it more obvious than ever before that all realistic, long-term solutions for New Jersey’s government-spending crisis must involve rolling back public-sector union officials’ special privileges, including, first and foremost, their monopoly privilege to speak regarding workplace issues for all front-line employees, including those who choose not to join the union and want nothing to do with it.

Despite his evident good intentions, Chris Christie has yet to demonstrate he is prepared to fight to narrow and ultimately eliminate government union chiefs’ monopoly-bargaining powers. But unless he does take on that fight, his efforts to bring New Jersey back from the brink are almost certainly doomed to fail.

UAW union officials imposed forced-dues contracts on Nissan employees

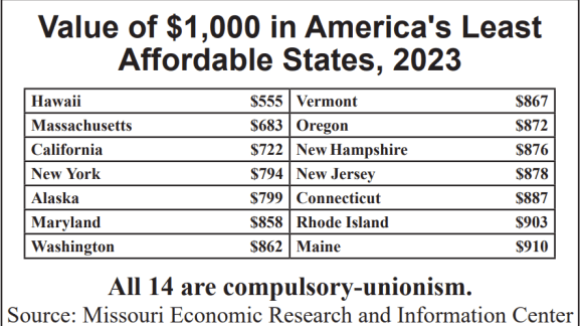

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

Thanks to the Committee's election-year program, union-label candidates like Sen. Jon Tester (Mont.) are being given a choice: pledge to change course and support Right to Work going forward, or face the potential political consequences.