Tyranny Triumphs in the Great Lakes State

Ignoring ample evidence of forced unionism’s unfairness and its damaging impact on jobs and incomes, Big Labor Michigan Gov. Gretchen Whitmer signed Right to Work destruction in 2023.

Readers know the difficulty Michigan is having creating jobs and economic prosperity. But defenders of Big Labor like to deny that the regulations and costs the United Auto Workers (UAW) and other big unions have imposed on the state have anything to do with the state’s mired economic conditions. Albeit already difficult, it is getting harder to make such an argument.

Phil Gramm and Mike Solon writing in the Wall Street Journalnote:

The Competitiveness Index created by the American Legislative Exchange Council (ALEC) identifies “16 policy variables that have a proven impact on the migration of capital — both investment capital and human capital — into and out of states.” Its analysis shows that “generally speaking, states that spend less, especially on income transfer programs, and states that tax less, particularly on productive activities such as working or investing, experience higher growth rates than states that tax and spend more.”

Ranking states by domestic migration, per-capita income growth and employment growth, ALEC found that from 1996 through 2006, Texas, Florida and Arizona were the three most successful states. Illinois, Ohio and Michigan were the three least successful.

The rewards for success were huge. Texas gained 1.7 million net new jobs, Florida gained 1.4 million and Arizona gained 600,000. While the U.S. average job growth percentage was 9.9%, Texas, Florida and Arizona had job growth of 18.5%, 21.4% and 28.9%, respectively.

. . .

There also appears to be a clear difference between union interests and the worker interests. Texas, Florida and Arizona are right-to-work states, while Michigan, Ohio and Illinois are not. Michigan, Ohio and Illinois impose significantly higher minimum wages than Texas, Florida and Arizona. Yet with all the proclaimed benefits of unionism and higher minimum wages, Texas, Florida and Arizona workers saw their real income grow more than twice as fast as workers in Michigan, Ohio and Illinois.

Incredibly, the business climate in Michigan is now so unfavorable that it has overwhelmed the considerable comparative advantage in auto production that Michigan spent a century building up. No one should let Michigan politicians blame their problems solely on the decline of the U.S. auto industry. Yes, Michigan lost 83,000 auto manufacturing jobs during the past decade and a half, but more than 91,000 new auto manufacturing jobs sprung up in Alabama, Tennessee, Kentucky, Georgia, North Carolina, South Carolina, Virginia and Texas.

Gramm and Solon ask whether any of these facts play into the presidential debate and the positions the candidates have on issues like Right to Work?

So what do the state laboratories tell us about the potential success of the economic programs presented by Barack Obama and John McCain?

Mr. McCain will lower taxes. Mr. Obama will raise them, especially on small businesses. To understand why, you need to know something about the “infamous” top 1% of income tax filers: In order to avoid high corporate tax rates and the double taxation of dividends, small business owners have increasingly filed as individuals rather than corporations. When Democrats talk about soaking the rich, it isn’t the Rockefellers they’re talking about; it’s the companies where most Americans work. Three out of four individual income tax filers in the top 1% are, in fact, small businesses.

In the name of taxing the rich, Mr. Obama would raise the marginal tax rates to over 50% on millions of small businesses that provide 75% of all new jobs in America. Investors and corporations will also pay higher taxes under the Obama program, but, as the Michigan-Ohio-Illinois experience painfully demonstrates, workers ultimately pay for higher taxes in lower wages and fewer jobs.

Mr. Obama would spend all the savings from walking out of Iraq to expand the government. Mr. McCain would reserve all the savings from our success in Iraq to shrink the deficit, as part of a credible and internally consistent program to balance the budget by the end of his first term. Mr. Obama’s program offers no hope, or even a promise, of ever achieving a balanced budget.

Mr. Obama would stimulate the economy by increasing federal spending. Mr. McCain would stimulate the economy by cutting the corporate tax rate. Mr. Obama would expand unionism by denying workers the right to a secret ballot on the decision to form a union, and would dramatically increase the minimum wage. Mr. Obama would also expand the role of government in the economy, and stop reforms in areas like tort abuse.

The states have already tested the McCain and Obama programs, and the results are clear. We now face a national choice to determine if everything that has failed the families of Michigan, Ohio and Illinois will be imposed on a grander scale across the nation. In an appropriate twist of fate, Michigan and Ohio, the two states that have suffered the most from the policies that Mr. Obama proposes, have it within their power not only to reverse their own misfortunes but to spare the nation from a similar fate.

Ignoring ample evidence of forced unionism’s unfairness and its damaging impact on jobs and incomes, Big Labor Michigan Gov. Gretchen Whitmer signed Right to Work destruction in 2023.

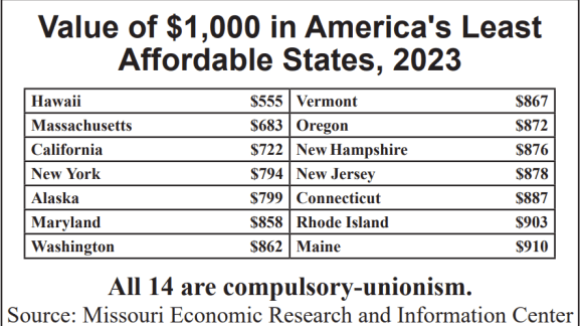

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

This winter top bosses of the Miami-based United Teachers of Dade (UTD) are indeed in danger of being thrown to the curb.