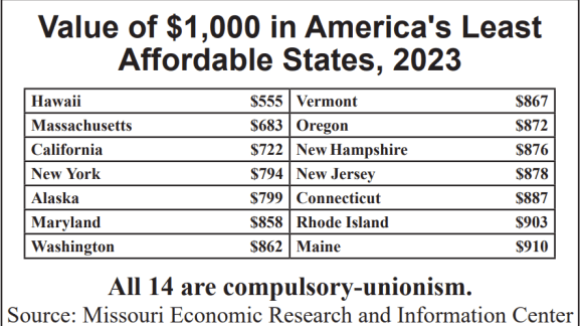

Banning Compulsory Dues Curbs Cost of Living

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

Big Labor Bosses have spent like drunken sailors trying to increase the support for forced unionism in Congress and the state legislatures, even borrowing millions against buildings that forced dues have paid for several times over. Yet, their drive for Card Check Forced Unionism (S. 560) remains elusive. So, how are President Obama and other Big Labor beholden politicians going to bailout labor bosses and their mismanaged pensions? Ivan Osorio and Vincent Vernuccio outlined a few possible ways in their Spectator article:

With EFCA facing a difficult political environment, union leaders are going after other items on their policy wish lists — and getting many of them. Vice President Joe Biden told the AFL-CIO Executive Committee in March that, “rebuilding our broken economy gives us the opportunity to get it right and reward workers.” More specifically, he was telling the AFL-CIO that the administration would reward unions. One vehicle for doing this is the gargantuan $787 billion federal stimulus bill.

… the administration is requiring (pdf) contractors who want to bid on large federal construction projects to be subject to project labor agreements (PLAs), which impose burdensome requirements on non-union contractors. PLAs typically require non-union employers — even those who provide their own benefits — to pay into union benefit plans. This can entail paying into underfunded union pension funds, which can impose huge liabilities on companies. PLAs may also require contractors to employ workers from union hiring halls, acquire apprentices from union apprentice programs, and require employees to pay union dues.

The administration and some congressional Democrats are also trying to bail out union pension funds. For taxpayers, this should be especially galling, as many of those funds are grossly underfunded because they have been poorly managed. For years, unions have leveraged their pension funds to pursue political agendas by introducing shareholder resolutions at public companies’ shareholder meetings and investing for political rather than economic goals. Often, such resolutions and investments do nothing to increase shareholder value. As a result, many union-sponsored multi-employer plan are today in critical condition.

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

Thanks to the Committee's election-year program, union-label candidates like Sen. Jon Tester (Mont.) are being given a choice: pledge to change course and support Right to Work going forward, or face the potential political consequences.

After union lawyers’ attempt to get the NLRB to block the vote failed, CWA union bosses backed down and departed AT&T workplace rather than face workers’ vote