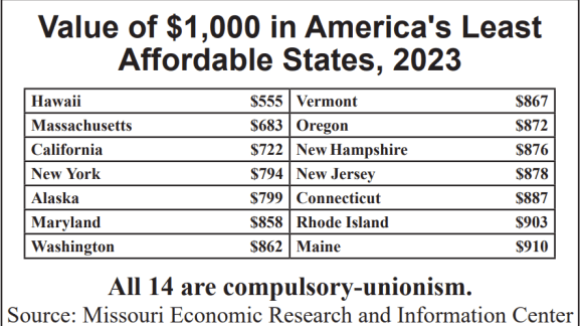

Banning Compulsory Dues Curbs Cost of Living

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

Even many state policymakers who acknowledge that the hate-the-boss class warfare waged by bosses of private sector unions has a detrimental impact on business investment and job creation discount the fact that government union-boss excesses typically cause the same problems. Elected officials naively ask, why should business owners worry about the coercive privileges wielded by government union bosses in a state if they never have to deal with them directly at the bargaining table?

In a chart and accompany commentary published Wednesday (see the link below), Steven Malanga of the Manhattan Institute quickly showed there is in reality a strong negative correlation between a state’s business-and-jobs climate (according to Chief Executive magazine’s latest annual survey of business leaders) and the share of its public workforce under government union officials’ control.

One reason why is that states with heavily unionized public sectors are far more likely than other states to have built up big government pension and healthcare liabilities. As one business executive commented in response to the survey, “Unfunded future pension and healthcare liabilities are future taxes that are at this point unknown.

Moreover, monopolistic unionism seems to incite anti-business owner attitudes among public as well as private rank-and-file employees:

“[Big Labor-dominated] NY, CA, & IL make it hard to desire to do business there due to deeply-rooted and ineffective socialist bureaucrats who get in the way with their secular social engineering and inherent distrust of business. They represent ‘ankle weights’ to focused business people trying to serve others with value, quality, and responsiveness.”

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

Big Labor Michigan politicians like Betsy Coffia arrogantly dismiss the expertise of independent-minded workers

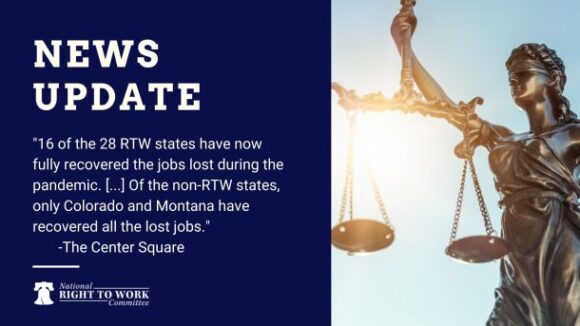

16 of the 28 RTW states have now fully recovered the jobs lost during the pandemic. Of the non-RTW states, only two have recovered all the lost jobs.