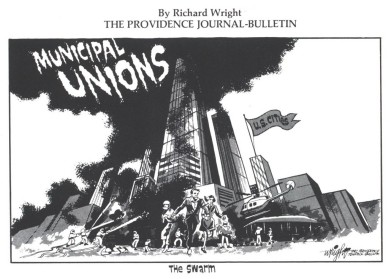

Union Bosses, Enemies of the 99%

Gary Beckner argues that the union bosses and Big Labor are enemies of the 99%:

Since the class-warfare message of the Occupy Wall Street protests started nearly two months ago, the two largest teachers unions, the National Education Association (NEA) and the American Federation of Teachers (AFT), have taken every chance possible to stand in solidarity with the group of mostly underemployed college students and left-leaning activists. With AFT President Randi Weingarten joining in protests and state affiliates taking part and organizing protests of their own, the teachers unions are quick to point out that “public education, teachers and unions have increasingly come under attack from the one percent,” as Leo Casey, spokesman for the AFT’s New York City local put it.

The union support is pouring in state after state. For example, in the union stronghold of California, California NEA affiliate President Dean Vogel called on the rich to pay more taxes. “It’s time to put Main Street before Wall Street, and for corporations to pay their fair share of taxes,” he said. Meanwhile, the union rank and file are resorting to taking the fight into the classroom with lesson plans titled “Who are the 99 percent? Ways to teach about Occupy Wall Street.”

As the protests continue and the union rhetoric becomes more radical, one can’t help but find the situation ironic. While the teachers unions claim they are being persecuted by the wealthiest Americans, clearly it is the unions and union bosses themselves that have benefited from a system that takes advantage of taxpayers at the expense of our students.

An examination of the staggering amount of money accumulated by the teachers unions puts the situation into perspective. The AFT collected $211 million in dues in 2010, while the even larger NEA pulled in $397 million. Taking into consideration affiliated state groups, the unions collectively take in about $1 billion, more than half of which is taken by force in states with compulsory unionism. If you take into account their vast budgets and revenue streams forcibly collected from teachers, the NEA and AFT numbers align nicely with those of the corporations they so vehemently criticize.

In terms of salaries, union executives rake in nearly 10 times the average household income. AFT President Weingarten collected nearly half a million dollars in 2010, a 15 percent increase from the previous year. Are teachers or anyone in the private sector experiencing those increases in times of financial hardship? Clearly, the teachers laid off in 2010 were not made aware of Weingarten’s impressive haul. Then again, when nearly 600 staffers at the NEA and AFT are raking in more than six figures, the interests of the rank and file seem far off.