Big Labor Lobbyist Dominate CA Legislative Agendas

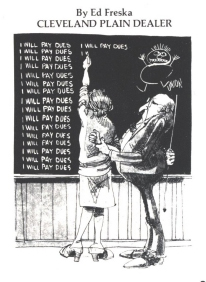

Brian Calle of the Orange County Register took notice when California's lobbying reports revealed that the biggest special interest in the Golden State is big labor. Specifically, the California Teacher's Association (read: Union) spent more money on lobbying than anyone else in the state. The President Obama says Big Labor is not a special interest. The facts show otherwise:

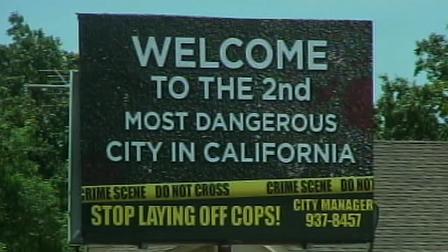

Lobbying, unsurprisingly, is commonplace and aggressive in U.S. state capitals and in Washington, D.C. Special interests and their paid representatives flock to legislators and bureaucrats, seeking favors, like pigs rushing to a full trough. The problem at the state and municipal level is that too many treasuries are depleted, and to refill the troughs special interests urge policymakers to find or enhance “revenue sources” – a euphemism for new or higher taxes.

In Sacramento, the California Teachers Association, the state's behemoth education union, spent more money on lobbying in 2011 than any other group in the Golden State, according a Los Angeles Times analysis of data from the California Secretary of State's Office.

The CTA, boasting 340,000 members, spent $6,574,257 last year, a lobbying tab more than $1.5 million greater than the second-place spender (unsurprisingly, another union), the California State Council of Service Employees, an affiliate of the Service Employees International Union, one of the largest and most powerful labor outfits in North America.