Somerset, NJ, Nissan Parts Distribution Center Employees File Petition for Vote to Kick Out UAW Union

UAW union officials imposed forced-dues contracts on Nissan employees

As practically anyone who has ever worked as an hourly employee in the private-sector knows, business owners are very careful about how they handle overtime expenditures. Government managers have less incentive to control overtime costs because it isn’t their money that’s at risk. But in the U.S. it is only in states where both union monopoly bargaining and compulsory union dues as a condition of employment are authorized in the public sector where government overtime expenditures are routinely handled in a way that is extremely unfavorable for taxpayers.

A news analysis published last weekend in the Courier Post, a newspaper serving southern New Jersey, describes how and why “some of the highest-paid insiders” in the Garden State’s government workforce are reaping a windfall as overtime costs for state and local taxpayers soar. (See the link below to read the whole story.)

Investigators for Gannett New Jersey have calculated that the overtime bill for New Jersey state government alone rose to $193 million last year. But they were unable to calculate the aggregate cost for the state’s 21 counties and 565 municipalities, in part because some “data reports were so jumbled that no computer could read the output without specialized programming.”

As reporters Bob Jordan and Paul D’Ambrosio observed, the overtime “is not shared equally among all workers.” Not remotely so:

Much of the overtime goes to the highest-paid employees – costing taxpayers untold tens of millions of dollars more each year. Workers at the lower end of the pay scale – those who could benefit the most from the extra pay while saving taxpayers money – are generally shut out of the overtime process, the investigation found.

Public-sector managers do not schedule overtime this way out of a sadistic disregard for taxpayers. Rather, New Jersey state law gives government union officials power to codetermine how overtime is allocated. And union bosses commonly demand, as Gloucester County spokeswoman Debra Sellitto explained to the Courier Post, that overtime be offered “on a rotating basis based on seniority”:

“For voluntary overtime — meaning the employee wants to work it — what this means is the most senior person is offered overtime, works it or rejects it, and then the next time, the next most senior person is offered, and so on down the line to eventually get to the least senior.”

Under many of New Jersey’s government-sector union contracts, the employees with the most seniority, normally the highest-paid workers, get preferential treatment whenever voluntary overtime is available.

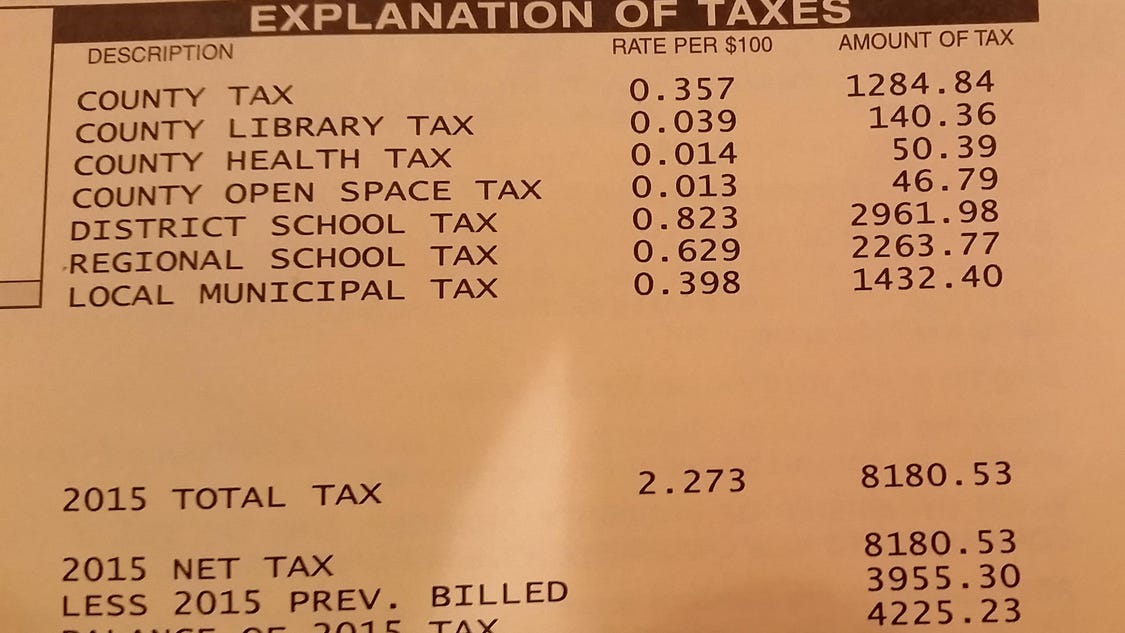

The cost to taxpayers is massive. At the Monmouth County Jail last year, the average time-and-a-half overtime pay was $63 an hour. Employees whose overtime pay was higher than the average racked up an average of 280 hours in overtime, or 60% more than the lower-paid workers. In 2015, the 241 officers who were paid $63 an hour or more for overtime took in an average of $20,800 in overtime compensation.

Rigging the system for determining which employees get the most, and which get the fewest, voluntary overtime hours is just one of an array of ways in which government union officials exploit the system to gouge New Jersey taxpayers. Another scheme is union contract provisions that “call for a minimum” of two hours of overtime pay “for any extra shift — even when only a few minutes of work is needed.”

According to the nonpartisan, Washington, D.C.-based Tax Foundation, state and local taxes combined consumed a total of 12.2% of New Jersey residents’ personal income in 2012, the most recent year for which data are available. That’s the third heaviest state-local tax burden relative to income in the U.S. The 16 states with the heaviest state-local tax burdens in 2012 all lacked Right to Work laws at the time. Meanwhile, 10 of the 12 states with the least burdensome state-local taxes are Right to Work.

Besides being grossly overtaxed, New Jersey is deep in the red. According to the Tax Foundation’s Facts and Figures 2016: How Does Your State Compare, the Garden State had a per capita state-and-local debt of $11,334. That’s worse than for all but six other states. And all of the 12 states with the greatest debt per capita in absolute terms lack Right to Work protections for employees.

UAW union officials imposed forced-dues contracts on Nissan employees

Multiple cases headed to High Court seeking ruling against arrangements that violate workers’ rights under 2018 Janus v. AFSCME Supreme Court decision

AG employee Heather Anderson is suing the IBEW Local 33 union and the State of New Jersey for illegally restricting her and her coworkers’ First Amendment right to stop union dues deductions from their paychecks.