Yesterday U.S. Bankruptcy Judge Steven Rhodes rejected government union lawyers’ claims that Detroit, despite its enormous and manifestly unsustainable debt burden, isn’t really bankrupt. As Bill McMorris reported for the Washington Free Beacon in the news account linked below:

. . . Rhodes affirmed that the Motor City was indeed insolvent and certified that it could move forward with plans to eliminate nearly $20 billion in debt.

Rhodes also made it clear that Detroit has the legal authority to reduce public employee pension benefits negotiated by government union chiefs who have for decades wielded monopoly-bargaining power under Michigan law:

“It has long been understood that bankruptcy law entails the impairment of contracts,” Rhodes said, while pledging that he “will not lightly or casually exercise power […] to impair pensions.”

Union bigwigs immediately vowed that they would appeal Rhodes’ decision. But any effort to get a higher court to overturn a bankruptcy judge’s ruling has to be regarded as a long shot.

Until now, Michigan’s pro-union monopoly state laws have made it virtually impossible for any elected official in Detroit to reform government employee compensation and work rules that were increasingly unaffordable for a city whose population was shrinking and getting poorer.

Unable to negotiate changes in wasteful union contracts encouraging healthy teachers, policemen, and other public employees to retire in their early fifties with taxpayer-funded medical insurance as well as pension benefits, city officials instead cut back again and again on basic public services.

The fact that Detroit had to file for bankruptcy to escape from Big Labor-supported government compensation schemes with such appalling consequences represents a black mark for state-level Michigan policymakers as well as Detroit politicians of the past and present.

Along with investors in Detroit’s general obligation bonds, public-sector retirees are expected to get hit especially hard as a consequence of the bankruptcy that government union chiefs who purport to “represent” such retirees helped foist on the city.

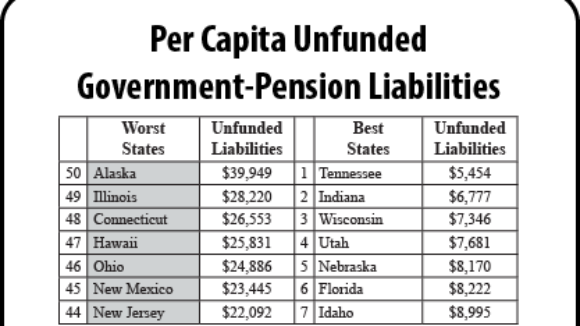

Detroit’s roughly 20,000 city retirees stand to lose most of their health benefits and a significant portion of their pensions. According to McMorris, half of Detroit’s $20 billion in debt comes from the city’s defined benefit pension system, “which was designed to guarantee workers a portion of their salary for life.”

Had they truly had union members’ best interests at heart and shown a modicum of foresight, union bosses would have taken the opportunity many years ago to negotiate defined-contribution plans, which are the property of employees and not susceptible to municipal bankruptcies.

Instead, Detroit union bigwigs pretended the retiree health plans and defined-benefit pensions they favored for unionized government workers were risky only for taxpayers.

It turns out union bosses’ promises to Detroit union members were hollow, and the risk of underfunded benefits was largely on public servants.

The Detroit fiasco will not have been in vain if it serves as a warning for civil servants and taxpayers around the country to revoke, or at least roll back, government union bosses’ monopoly privileges to negotiate taxpayer-funded public employee pay and benefits before it’s too late.

At first, it may seem that public-sector monopoly-bargaining laws are a means for government employees to enrich themselves at the private sector’s expense. But as Detroit shows, in the long run the only beneficiaries of such special-interest statutes are the government union bosses who collect dues and fees (compulsory in more than 20 states) from civil servants.

Judge: Detroit Bankruptcy Can Proceed, Pensions to Be Cut