Banning Compulsory Dues Curbs Cost of Living

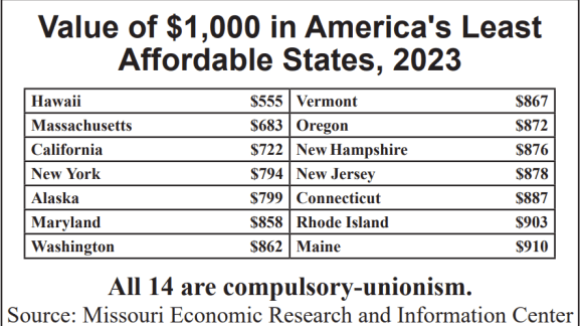

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

From Forbes Magazine:

At least the individual income tax reduction makes Kentucky more competitive, right?

While Governor Beshear’s plan simplifies tax brackets and lowers rates, it does not address the issue of municipal income tax rates in Kentucky. Eight cities currently levy an income tax on residents and non-residents – a tax structure similar to that of Detroit, Michigan. Louisville, for example, levies a personal income tax rate of 2.2 percent for residents and 1.45 percent for non-residents, resulting in a total state tax burden of 8.2 percent for those living within city limits. That’s just 0.62 percent less than New York, the most heavily taxed state in the U.S. A reduced income tax rate of 5.75 percent for middle-class families making over $50,000 a year does little to alleviate the total tax burden once city taxes are factored into the equation.

According to Internal Revenue Service data contained with How Money Walks, Kentuckians are leaving their state for more tax-friendly states such as Florida, Tennessee, North Carolina (which reduced income tax rate in 2013 to 5.8 percent), South Carolina, and Texas. Based on calculations from www.SaveTaxesByMoving.com, a sales representative (wholesale and manufacturing, technical and scientific products) making $89,440 (Bureau of Labor Statistics) a year could earn over $800,000 more in his or her lifetime by moving from Louisville, Kentucky to Jacksonville, Florida. Is it any wonder why Florida is the number one destination over the past 18 years for working wealth from the Bluegrass State?

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

Thanks to the Committee's election-year program, union-label candidates like Sen. Jon Tester (Mont.) are being given a choice: pledge to change course and support Right to Work going forward, or face the potential political consequences.

Biden judicial nominee Nicole Berner has a track record of mindlessly repeating union bosses’ anti-Right to Work diatribes and defending their schemes to profit at the expense of the disabled.