"The Stockton Syndrome" Underfunded Pensions

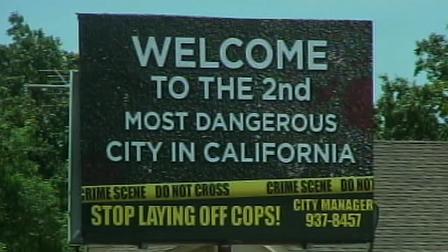

California laws granting immense union monopoly power to union officials is creating cracks, fissures, and collapse across the state. One manifestation of the growing problem is a pension crisis coming to a head as the city of Stockton faces pending bankruptcy. The Investor Business Daily notes: As one California city slogs toward bankruptcy, others may soon try to avoid the same fate by passing pension reforms — that is, if a pro-union state government will let them. The financial problems plaguing many of the nation's [Big Labor Boss-run] cities are taking a particularly heavy toll on Stockton, Calif., a blue-collar port city that struggles even in good times. Stockton is also a cautionary tale on how not to run a city. It seems to have committed just about every fiscal sin known to local government.In those infrequent years when things were good, it spent (and promised) like there was no tomorrow. Now tomorrow has come, and the city is broke. Its spiffy sports arena and its new $35 million high-rise city hall won't help it pay its debt. That debt includes, but is not limited to, a $400 million liability for its retirees' health care. It also has had to cut its police force by almost a third.