Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

Tax Burdens Heavier in Forced-Dues States

Lower Housing, Energy Costs Magnify Right to Work Tax Advantage

On April 16, according to the nonpartisan, Washington, D.C.-based Tax Foundation, “Tax Freedom Day” (TFD) 2019 finally arrived.

The Tax Foundation’s entire analysis is available at www.taxfoundation.org — the group’s web site.

As the Tax Foundation explains, TFD is “the day when the nation as a whole has earned enough money to pay its total tax bill for the year.”

TFD “takes all federal, state and local taxes and divides them by the nation’s income.”

According to the Tax Foundation’s current estimate, this year Americans will pay “$3.42 trillion in federal taxes and $1.86 trillion in state and local taxes, for a total tax bill of $5.29 trillion . . . .” That’s 29% of all the nation’s income.

In Right to Work States, Employees Get Nearly Two Extra Weeks’ Take-Home Pay

Besides calculating when TFD comes annually each year in the nation as a whole, the Tax Foundation calculates when TFD arrives in each of the 50 states.

Not surprisingly, the burden of taxation is not borne equally by all Americans.

Several factors significantly influence when TFD comes for individual taxpayers and households.

The Tax Foundation highlighted two in its report: The total tax burden borne by residents of different states varies considerably due to differing state policies and the progressivity of the federal tax system.

Soon after the Tax Foundation issued its report on TFD 2019, the National Institute for Labor Relations Research calculated average TFD’s for the 27 Right to Work states as a group and the 23 forced-dues states as a group.

To derive aggregate TFD’s for states where compulsory union dues are either permitted or prohibited, the Institute used state personal income data for 2018 as reported by the U.S. Commerce Department and the estimated 2019 TFD’s for the 50 states as reported by the Tax Foundation.

The Institute estimates that this year residents of forced-unionism states are forking over 30.6% of their total peronsal income in taxes.

“That’s a 13% higher share than the Right to Work state average,” commented National Right to Work Committee Vice President Greg Mourad.

“TFD in compulsory-unionism states as a group didn’t come until April 22 this year.

“In contrast, TFD in Right to Work states as a group came on April 9, or nearly two weeks earlier than the forced-unionism average.”

Cost of Living-Adjusted Employee Compensation Higher In Right to Work States

Mr. Mourad continued:

“In part, TFD comes significantly earlier in Right to Work states than in forced-unionism states because state and local taxes typically consume a smaller share of income in jurisdictions where unionism is voluntary.”

Another advantage for Right to Work states is their lower living costs.

As the Institute reported earlier this year, interstate cost-of-living indices calculated by the Missouri Economic Research and Information Center show that on average forced-unionism states were 27.6% more expensive to live in than Right to Work states in 2018.

Thirteen of the 14 most affordable states have Right to Work laws on the books, but not one of the 14 least affordable states has one.

When cost-of-living differences are factored in, the average compensation per employee is higher in Right to Work states than in forced-unionism states.

However, progressive federal income taxes are levied on nominal, rather than cost of living-adjusted incomes.

Households in High-Cost Big Labor Stronghold States ‘Get Socked Twice’

Consequently, explained Mr. Mourad, households in high-cost forced-unionism states like California, New York, New Jersey, Connecticut and Massachusetts “get socked twice.”

“They have to fork over more for housing, food, energy, health care, and other necessities,” Mr. Mourad noted.

“And then they have to pay the same federal income tax rate as a household in a low-cost Right to Work state like Texas or North Carolina making the same nominal income, even though that nominal income goes much further in Right to Work states.”

The TFD disparity, concluded Mr. Mourad, is a prime example of how the forced-unionism system hurts practically everyone, and not just freedom-loving employees and business owners who are directly affected.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

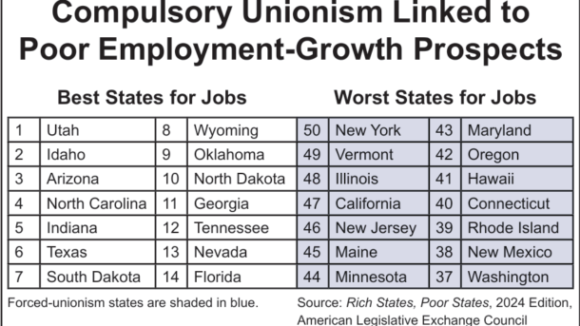

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

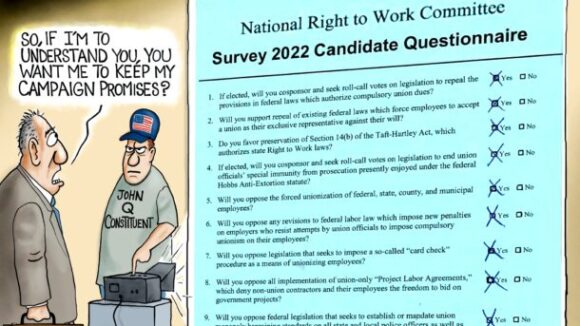

Members Insist They Keep Pro-Right to Work Campaign Promises