Windfall For Derelict Union Pension Fund Chiefs

“The $86 billion giveaway to MEPPs inserted in the Biden Administration’s so-called ‘American Rescue Plan’ [ARP] has set the stage for even bigger bailouts in the future.”

While big labor’s pension plans for workers are completely underfunded, the union boss pension plans are a different story:

Pension plans for union officers remain healthy and well-funded even as rising liabilities threaten to consume the savings of their rank and file counterparts who participate in different funds within the same labor organization, according to a Hudson Institute study.

This disparity became evident from a sample of the 21 largest union and staff pension plans from the same organizations. They are: The Service Employees International Union, UNITE-HERE, the United Steelworkers, the United Food and Commercial Workers, the Plumbers and Pipefitters, the International Brotherhood of Electrical Workers, the Sheet Metal Workers and the Bakery, Confectionary, Tobacco Workers and Grain Millers International Union.

“This issue of rank and file pension plans being funded less than the officer pension plans is extraordinarily serious and shows a great moral failing on the part of the unions,” said Diana Furchtgott-Roth, a senior fellow with the Hudson Institute who authored the study.

“They’re just not putting enough money into the rank and file plans. My suspicion is that when unions bargain with an employer for a benefits package they are focusing on wage increases because this is more visible to the membership and they are not focusing on pension benefits.”

“The $86 billion giveaway to MEPPs inserted in the Biden Administration’s so-called ‘American Rescue Plan’ [ARP] has set the stage for even bigger bailouts in the future.”

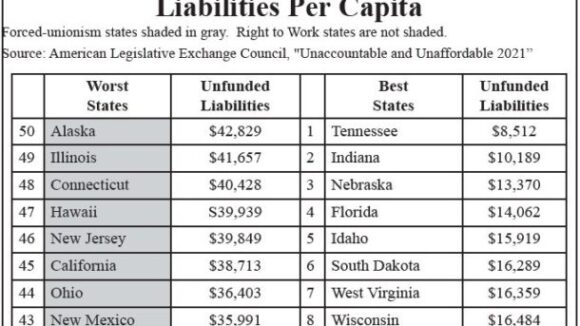

On average, unfunded pension liabilities per capita are 43% lower in Right to Work states than in forced-unionism states.

State laws protecting employees’ Right to Work are strongly correlated with better- funded public pensions. On average, unfunded pension liabilities per…