Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

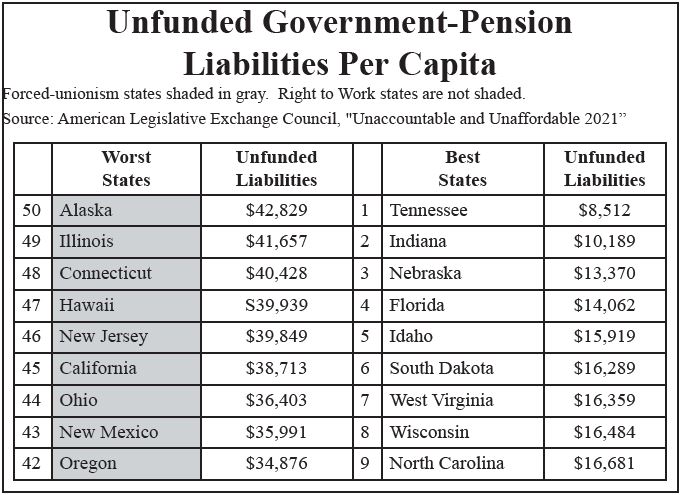

The latest update of “Unaccountable and Unaffordable,” an annual report by the American Legislative Exchange Council (ALEC), was issued this June. It shows that unfunded state pension liabilities skyrocketed by 42%, or $2.45 trillion, from Fiscal Year 2020 to Fiscal Year 2021.

This was by far the greatest annual increase in unfunded pension liabilities since ALEC began issuing this report in 2017.

National Right to Work Committee Vice President Matthew Leen commented:

“The new ALEC report on unfunded pension liabilities adds to the mountain of evidence that union officials endowed with monopoly privileges routinely wield them to jack up governments’ long-term spending commitments.

“As a consequence of Big Labor’s back-room deals and lobbying blitzes, states that give more special privileges to union officials routinely burden their citizens with more debt as well as heavier taxation.

“According to ALEC’s current calculation, unfunded liabilities of state-administered pensions, using a proper, risk-free discount rate, add up to nearly $25,000 ‘for every man, woman and child in the United States.’

“The 23 states that have yet to adopt Right to Work laws prohibiting forced union dues and fees have an average unfunded per capita pension liability of $31,914.

“In contrast, the 27 states with Right to Work laws in effect have a large, but more manageable per capita pension liability that is roughly 43% lower.

“All of the nine states with the greatest per capita pension liability — Alaska, Illinois, Connecticut, Hawaii, New Jersey, California, Ohio, New Mexico and Oregon — foist forced union dues and fees on employees.”

Mr. Leen added: “In contrast, all of the 15 states with the lowest per capita pension liability are Right to Work states. And four of the states with the best-funded pensions — Indiana, Michigan, West Virginia and Wisconsin — approved their bans on forced union dues since 2012, with National Right to Work furnishing expert advice and lobbying support in each case.”

It’s not difficult to see how Right to Work laws prevent politicians’ irresponsibility from getting completely out of hand.

In jurisdictions where forced union dues have been permitted and union monopoly bargaining in the public sector has been authorized for years, government employers negotiate exclusively with union bosses over civil servants’ pay, benefits, and work rules.

Meanwhile, for many years, government union chiefs funneled a large portion of the compulsory dues and fees they collected into efforts to influence the outcomes of state and local elections. And those outcomes have often determined who represents the public at the bargaining table.

In 2018, the U.S. Supreme Court threw out a lifeline to fiscally troubled Big Labor stronghold states like Connecticut, Illinois, and New Jersey with its Janus decision.

Ruling in favor of an independent-minded Illinois civil employee in a case argued and won on his behalf by a Right to Work Foundation staff attorney, the High Court found that extracting forced fees from public employees as a job condition violates the First Amendment.

“Janus was primarily a victory for individual rights,” said Mr. Leen.

“Its potential impact on state budgets is also vast. Janus is giving lawmakers in state after state an opportunity to reassert control over how public employees are compensated and protect taxpayers.

“But much remains to be done, as the recent experience of Big Labor-dominated New Jersey illustrates.

“A report released in June by New Jersey’s Office of the State Auditor calculated that, in 2021 alone, the Garden State’s long-term debt, including pension costs, rose by $248.6 billion.

“And because net totals of 10,000 or more tax filers are fleeing New Jersey every year, most of them headed to Right to Work states that treat income earners less shabbily, this rapidly growing debt burden is being carried by fewer and fewer taxpayers.

“New Jersey illustrates how repeal of government-sector monopoly-bargaining statutes and passage of additional state laws protecting private-sector employees’ Right to Work are indispensable parts of public budget reform.”

This article was originally published in our monthly newsletter. Go here to access previous newsletter posts.

To support our cause and help end forced unionism, go here to donate.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

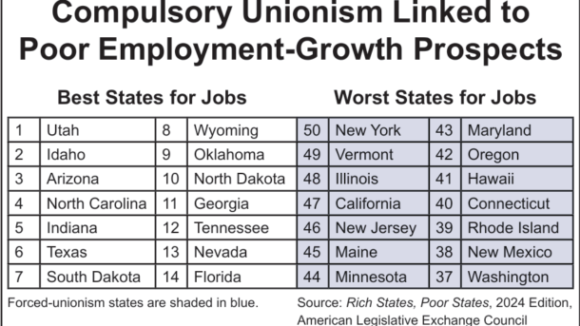

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

Members Insist They Keep Pro-Right to Work Campaign Promises