Foundation: Texas Taxpayers Shouldn’t Be Forced to Fund Union Activities

Brief says Janus explains why Texas Supreme Court must invalidate ‘official time’ scam

Brief says Janus explains why Texas Supreme Court must invalidate ‘official time’ scam

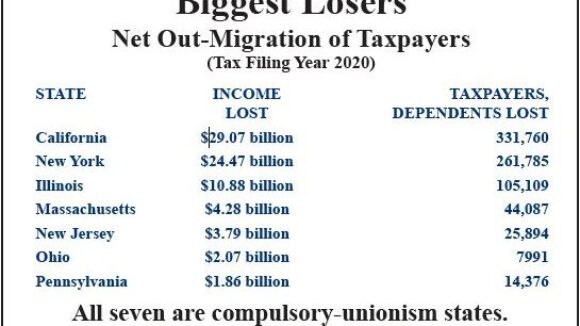

Year after year, far more taxpayers are moving out of forced-unionism states than are moving into them. And forced-unionism states’ income losses due to taxpayer out-migration are soaring.

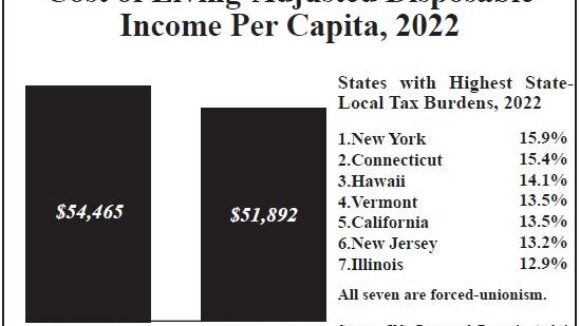

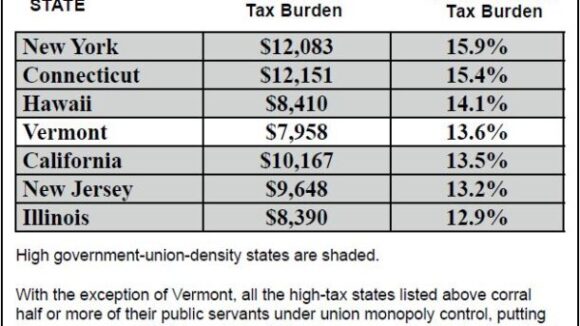

One reason why spendable income is higher in Right to Work states is forced-dues states’ substantially higher state-local tax burdens.

Tens of millions of employees are understandably alarmed by President Biden’s approval of a doubling of the IRS budget. But federal union bosses are eagerly anticipating more troops for their political army. (Credit: A. R. Branco/ NRTWC) Cost Will Largely…

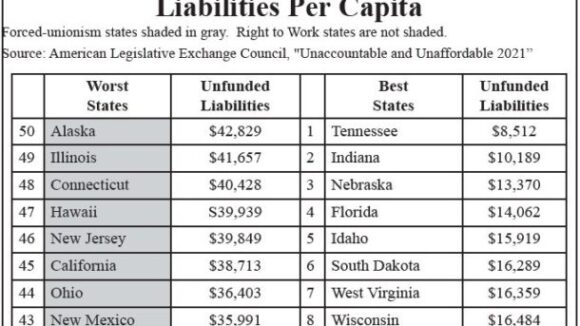

On average, unfunded pension liabilities per capita are 43% lower in Right to Work states than in forced-unionism states.

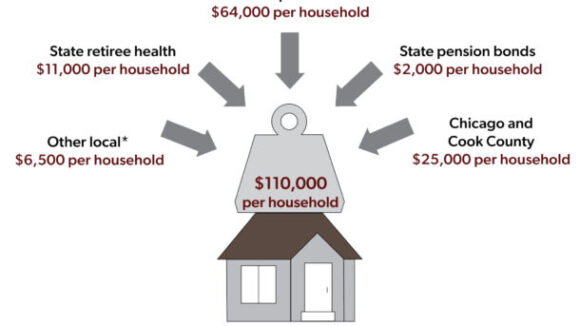

Taxpayers in forced-unionism Illinois have seen their tax burdens skyrocket, their public debt liability soar, and the quality of their K-12 schools and other vital public services deteriorate.

There is a close connection between monopolistic government unionism, punitive taxation, and ineffective schools and public-safety departments.

Here is a brief overview of the November/December National Right to Work Newsletter: Biden NLRB Plots Lawless War on Workers: Union Officials Applaud Top Board Lawyer’s ‘Card Check’ Scheme Worker Freedom at Stake in Virginia Elections:…

Big Labor radicals like Ms. Henry are “fighting like h***” for enactment of the multitrillion-dollar Tax & Spend scheme for a host of reasons.