Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

Late this summer, Big Labor chalked up a big victory as it successfully lobbied for enactment of a scheme (H.R.5376) that will increase federal spending by hundreds of billions of dollars in an era of trillion-dollar deficits.

The high cost of the additional spending and the putative “deficit reduction” component of the legislation will ultimately be borne by ordinary families as well as taxpaying businesses.

The primary means through which H.R.5376 will raise taxes is through imposition of a new “book minimum tax.”

This provision sharply limits the ability of many businesses, especially in the manufacturing sector, to write off the cost of certain job-creating capital investments.

And competent economists of all stripes recognize that the thousands and thousands of businesses who get hammered by H.R.5376’s higher taxes will have to pass on the cost to employees, consumers, and shareholders in the form of lower pay, higher prices, and lower stock returns.

National Right to Work Committee President Mark Mix said that, as damaging as the higher tax extractions from the private economy will be, even worse are the innumerable H.R.5376 provisions that shield Big Labor and a handful of other special interests favored by the Biden Administration from the tax hikes:

“As a Wall Street Journal editorial published just before the Senate okayed H.R.5376 in a 51-50 vote, with every Democrat senator voting ‘yes’ and Vice President Kamala Harris breaking the tie, H.R.5376 is ‘marbled with political and union favoritism.’

“Just for starters, H.R.5376 sets a new ‘base tax credit’ for solar and wind production of $5.20 per megawatt hour (MWh).

“But if contractors for renewable energy projects acquiesce to labor regulations that effectively ensure their employees will be unionized, they will be able to claim a tax credit of ‘$26 per MWh.’ That is, five times as high.

“No plausible environmental or consumer interest is advanced by such provisions. They are an unabashed payoff to Big Labor.”

In a letter opposing H.R.5376 emailed to members of Congress and the White House in early August, Right to Work Director of Federal Affairs Jace White highlighted several other ways in which this measure, laughably sold as “inflation reduction,” rigs the economy on behalf of union special interests.

For example, while the overwhelming majority of employee pension plans in the U.S. will be subject to H.R.5376’s “book minimum tax,” undoubtedly lowering the return on retirement investments, “Section 56A(c)(11) of the bill creates special loopholes” in this tax “for union pension plans,” explained Mr. White.

Effectively, Big Labor-controlled, and badly mismanaged, “multiemployer” pension plans, which received an $86 billion, taxpayer-funded bailout just last year as part of Joe Biden’s mislabeled “American Rescue Plan,” will get a new special subsidy.

Meanwhile, pension plans for union-free workers will not.

“Even the most publicly controversial part of H.R.5376, the $80 billion expansion of the IRS budget, which according to a 2021 Treasury Department analysis will allow the agency to add nearly 87,000 full-time employees to its staff over the next decade, will be a boon for Big Labor,” said Mr. Mix.

“Vast numbers of Americans understandably fear that doubling the size of the army of IRS agents will inevitably mean far more harassing audits of families at all income levels and small businesses.

“Such concerns were compounded when, just before H.R.5376 was pushed through the Senate, all 50 members of the chamber’s union-label Democrat caucus banded together to defeat an amendment that would have barred the new IRS hires from auditing individuals and firms with under $400,000 in taxable income.

“But Big Labor bosses and the union-label politicians who depend on their political machine to get elected and reelected live in a different universe.

“For them, the most important consideration regarding the 87,000 new IRS agents who will be added to the federal payroll under H.R.5376 is that virtually all of them will be subject to the monopoly-bargaining power of the National Treasury Employees Union.

“Because they will be forced to allow the NTEU hierarchy to speak for them on a wide array of matters related to their working lives, these agents will be under powerful compulsion to join and pay dues to the union.

“It is a safe bet that the NTEU, which so far has given nearly 99% of its federal political cash contributions in the 2021-22 campaign cycle to Democrat candidates, will become much more powerful politically thanks to H.R.5376.

“And the entire union political machine will become even larger.”

Private-sector and government-sector union bosses alike are eagerly taking the credit for H.R.5376.

Among the private-sector Big Labor chiefs leading the applause for the scheme were Teamster President Sean O’Brien, AFL-CIO President Liz Shuler, United Food and Commercial Workers President Marc Perrone, and UNITE HERE! President D. Taylor.

Mr. Mix commented:

“It’s not that Mr. O’Brien, Ms. Shuler, Mr. Perrone, and Mr. Taylor are unaware that the new $6.5 billion tax on natural gas production and new 16.4 cents per barrel tax on crude oil will increase the amount of money the employees they supposedly ‘represent’ have to pay to heat their homes and drive their cars.

“It’s just that Big Labor bosses are much more interested in the benefits H.R.5376 will bring to them than the harm it will inflict on workers.

“The determination of the politicians who control the White House, the U.S. Senate, and the U.S. House to turn this bill into law, despite the fact that even proponents recognize it will do nothing to stem the rampant inflation that is the chief economic concern of Americans right now, is dumbfounding. It also highlights the need for national Right to Work legislation empowering millions of private-sector employees to refuse to bankroll unions that don’t speak for them.”

“This summer,” Mr. Mix continued, “radical union bosses like Sean O’Brien, Liz Shuler, Marc Perrone, and D. Taylor shoveled forced-dues money into a successful blitz to enact a Tax-and-Spend monster that will lower real spendable incomes and wipe out good-paying jobs for private-sector employees.

“But once the National Right to Work Act [S.406 and H.R.1275] becomes law, no employee will be forced to bankroll the Teamsters or the UFCW, or any other union, simply in order to keep their jobs and provide for their families.

“Thanks to Committee members’ efforts, the Right to Work Bill now has a total of 134 congressional sponsors. And after the American people have their say in this November’s elections, I am optimistic support on Capitol Hill will be higher still.”

This article was originally published in our monthly newsletter. Go here to access previous newsletter posts.

To support our cause and help end forced unionism, go here to donate.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

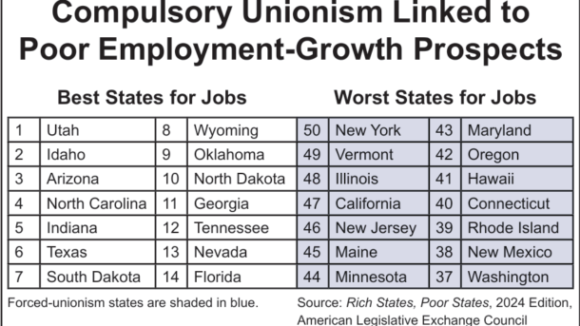

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

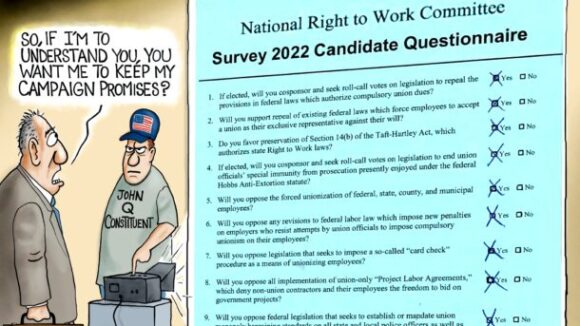

Members Insist They Keep Pro-Right to Work Campaign Promises