Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

For many years now, astute observers of American public policy have recognized there is a close connection between monopolistic government unionism, punitive taxation, and ineffective schools and public-safety departments.

More than 30 years ago, for example, then-Forbes Executive Editor James Cook wrote a landmark article, entitled “Collision Course,” for the May 13, 1991 edition of his publication. Mr. Cook confronted the “reality” that “powerful public services unions are a principal culprit behind swollen public payrolls and deteriorating public services.”

As a consequence of the recession of 1990-91, a number of that era’s Big Labor politicians, including then-New York Gov. Mario Cuomo, were trying as “Collision Course” was written to roll back, very modestly, the enormous increases in unionized government employee ranks of the 1980’s.

In the Empire State, wrote Mr. Cook, “the number of workers on state payrolls had grown” 14 times as fast as the overall population during that period of rising national prosperity.

To close the state’s $6.4 billion budget gap, Mr. Cuomo proposed in early 1991 to pare back the 65,000 increase in the state’s overwhelmingly unionized government workforce that had occurred from 1980 to 1989.

Outraged Big Labor bosses and their PR flacks struck back immediately, and brutally. The proposed staff reductions would, an array of media reports began to warn, “close the children’s petting zoo in Central Park, cut back services to handicapped children, and eliminate violin lessons in Harlem schools.”

Without a doubt, after the 1980-89 hiring fest, there was a great deal of “supervisory bloat” in New York government. But union bosses insisted even a little spending restraint would sharply cut “genuine services.”

“Ultimately,” concluded Mr. Cook, politicians would have to choose between “the needs of the public and the demands” of public-sector union bosses.

Today, it is plain that many politicians in state after state have made their choice — against the needs of the public.

While government union chiefs push hard for higher taxes and more public spending in all 50 states, they naturally do so with greater success in states that authorize and promote union monopoly bargaining over public workers’ terms and conditions of employment.

Well over 30 states legally require public employers, under certain conditions, to recognize a government union as the “exclusive” (monopoly) bargaining agent for their employees with regard to pay, benefits, and work rules.

Meanwhile, several states have no statewide statute or state constitutional provision forcing any government employer to engage in any form of bargaining with any union.

And one state, North Carolina, has a statutory prohibition against any government-sector bargaining.

One rough, but useful gauge of how much coercive power union kingpins wield in any state is the share of public servants who are subject to union monopoly bargaining.

This is reported in the Union Membership and Coverage Database, constructed and maintained by economists Barry Hirsch and David Macpherson.

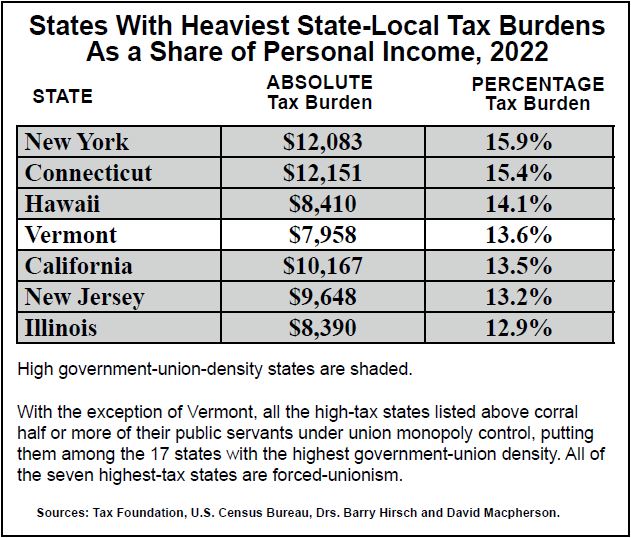

By simultaneously reviewing government-union-density data for 2021 and data on estimated 2022 state-and-local tax collections as reported by the Washington, D.C.-based Tax Foundation, one may get a grasp of just how valuable monopoly-bargaining privileges are for tax-hungry union bosses.

Among the 17 states with the highest share of public employees under union monopoly control, state and local taxes combined will consume roughly 12.6% of all personal income this year.

That represents an aggregate state-and-local tax burden 29% heavier than the aggregate burden for the 16 states ranking in the middle for monopoly-bargaining density, and 33% heavier than the average for the 17 states where government union bosses wield the least coercive power.

In other words, this year, residents of government-union-stronghold states will have to work over a week-and-a-half longer just to pay off their state-local taxes, compared to states where relatively few, if any, public employees are forced to accept union representation.

Six of the seven states with the heaviest aggregate state-and-local tax burdens are high government-union-density states.

And just one of the 15 states with the lowest state-local tax burdens is a high government-union-density state.

What quality services do residents of Big Labor-dominated states get in exchange for paying higher taxes?

The fact is, many workplace policies regarding employee pay, benefits, and work rules that union officials commonly advance by wielding their monopoly-bargaining privileges reduce the quality of public services even as they raise costs for beleaguered taxpayers.

A case in point is Kentucky union bosses’ campaign this spring to block Jefferson County Public Schools (JCPS) Superintendent Marty Pollio from offering a salary incentive to educators who accept challenging job assignments at high-poverty schools in Louisville.

Under the government union contract currently encumbering JCPS, which prohibits such incentives, it is difficult to recruit and even harder to retain qualified, capable, and committed teachers for jobs in schools with many disadvantaged students.

Consequently, children attending high-poverty schools are often instructed by teachers who aren’t fully conversant in their subject areas and/or are indifferent about their students’ academic success.

Jefferson County teacher union chief Brent McKim doesn’t care about that.

Instead, he favors exorbitant compensation policies that flat-out ignore the obvious differences between teaching at a school where 85% of the students are in poverty and teaching at a school where few if any of the children are poor.

The National Right to Work Committee and its over two million members have long opposed state laws authorizing and promoting deals in which the bosses of a single union become civil servants’ “exclusive” voice on workplace matters.

“For a long time, opposition to state laws permitting and actively encouraging monopolistic government unionism was a lonely fight for the Committee,” acknowledged Mr. Mix.

“But grassroots opposition to union takeovers of public employees has been on the rise for some time now.

“Just last year, concerned citizens in Arkansas, assisted by the Committee, successfully pushed for passage of legislation banning monopolistic unions in schools, colleges and courts.

“And this year, the Committee helped pro-taxpayer activists in Colorado block a scheme to extend Big Labor’s power to mandate monopoly bargaining to education employees, despite union-boss operational control of the state capitol.

“Unfortunately, Big Labor may yet succeed in ramming through a bill corralling Colorado county employees into unions.

“Probably the most significant current battle against government union excesses is unfolding in Virginia. This February, the state House of Delegates approved legislation that would roll back Big Labor monopoly bargaining over teachers and many other public servants.

“A week before this bill was approved by the House, a Committee officer traveled to Richmond to testify in its favor.

“Unfortunately, this year, the Virginia state Senate, whose members did not have to face the voters in the Old Dominion’s 2021 elections, blocked monopoly-bargaining repeal. But the issue isn’t going away, and every member of the Virginia General Assembly knows it.”

This article was originally published in our monthly newsletter. Go here to access previous newsletter posts.

To support our cause and help end forced unionism, go here to donate.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

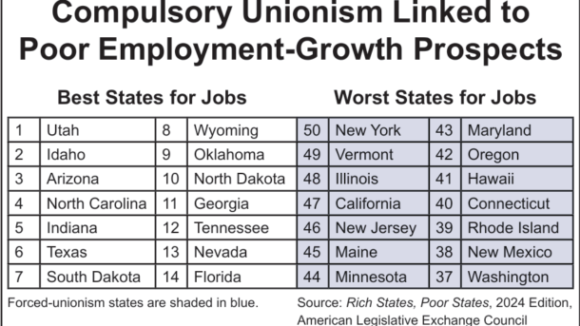

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

Members Insist They Keep Pro-Right to Work Campaign Promises