Will Team Biden Weaponize Workers’ Pensions?

Big Labor abuse of worker pension and benefit funds as a means of advancing union bosses’ self-aggrandizing policy objectives is a familiar phenomenon.

Economists who wish to compare living standards among various countries routinely use purchasing power parity (PPP) in their calculations.

As the Economics Online website explains, PPP is a means of determining the relative value of currencies based on “the quantity of the currency needed to purchase a given unit of a good, or common basket of goods and services.”

PPP thus refers to equalizing “the purchasing power of two currencies by taking into account . . . cost of living and inflation differences” between the countries that use those currencies.

Of course, PPP rates can’t be calculated with absolute precision. But there is nevertheless a wide consensus that they enable researchers to make a much more reliable assessment of a country’s relative living standards than do official exchange rates.

Even within a single country with a single currency, the currency’s purchasing power can differ greatly.

That’s why economists who use PPP to compare living standards among various countries should also logically try to control for intranational, regional differences in purchasing power.

Financial journalist Felix Salmon once put it this way: “If PPP make sense — and it does, in many ways — then shouldn’t we be using it when we compare New York to, say,

Illinois? The purchasing power of the U.S. dollar varies widely from state to state. Is there some way of incorporating that into statistics?”

Indeed, for years now, a domestic PPP gauging interstate cost-of-living differences has been regularly calculated and updated by the Missouri Economic Research and Information Center (MERIC).

As a state government agency, MERIC has no ax to grind on the Right to Work issue.

Its interstate cost-of-living indices factor in housing, food, utilities, transportation, health care, and other miscellaneous consumer goods and services.

And for roughly two decades, the National Institute for Labor Relations Research has used MERIC’s indices to make apples-to-apples comparisons of wages, salaries, and other forms of income in Right to Work and forced-unionism states.

MERIC’s annual data for 2022 show that, among the 14 states with the highest overall cost of living last year, not one has a Right to Work law.

But 10 of the 11 lowest-cost states are Right to Work.

When 2022 disposable personal ncome (personal income minus taxes) data, as reported by the U.S. Commerce Department’s Bureau of Economic Analysis, are adjusted for differences in living costs, the results show that four of the five highest-ranking states have Right to Work laws.

Meanwhile, four of the five bottom ranking states lack Right to Work laws.

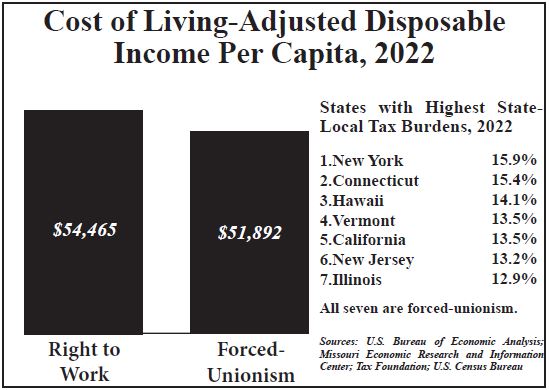

Overall, the Institute found that the average cost of living-adjusted disposable income per capita in Right to Work states last year was $54,465, nearly $2,600 higher than the forced-dues-state average.

National Right to Work Committee President Mark Mix commented on the Institute’s findings:

“No one should be surprised that Right to Work states enjoy a purchasing power advantage over forced-unionism states equivalent to more than $10,000 a year for a family of four.

“As eminent economist Richard Vedder explained in a brief analysis of such laws’ impact published by the New York Times in 2015, ‘Capital moves to right-to-work states with a more stable labor environment, and that increases labor demand and, ultimately, income and wages.”’

Mr. Mix continued:

“Another key job-creating advantage Right to Work states enjoy is substantially less burdensome taxes.

“Largely because Big Labor funnels a huge share of the forced dues and fees it extracts from workers into the campaigns of Tax & Spend politicians, state-local taxes consume 12.6% of all income in forced-unionism states, according to data furnished by the non-partisan, Washington, D.C.-based Tax Foundation.

“That’s a 33% heavier burden than the Right to Work average!

“Ordinary Americans know they’re better off in Right to Works states.

“That’s a major reason why the share of the U.S. population living in states barring forced unionism soared from 29% in 1970 to 51% last year.

“To quote Dr. Vedder again, ‘the quality of life is perceived as better in [Right to Work] states — so millions have moved there.’”

“There is no half-way plausible economic or moral justification for keeping on the books any federal or state laws that authorize the firing of employees for refusal to pay dues or fees to an unwanted union,” added Mr. Mix.

“Responsible elected officials should be fighting for repeal of all such forced-unionism laws.

“Passage of H.R.1200 and S.532, legislation commonly referred to as the National Right to Work Act, would be a major step in the right direction.”

H.R.1200 and S.532, respectively introduced in the House by Rep. Joe Wilson (R-S.C.) and in the Senate by Sen. Rand Paul (R-Ky.), would eliminate all the provisions in the National Labor Relations Act and the federal Railway Labor Act that authorize forced union dues and fees as a job condition.

The Committee is now lobbying hard to secure Capitol Hill hearings and rollcall votes on these measures.

The House and Senate bills had a total of 92 congressional sponsors and cosponsors when this Newsletter edition went to press in early May.

“When forced-dues repeal becomes law, employees in all 50 states will have the freedom to choose as individuals whether or not to join or pay dues to a union, without facing job loss as a consequence of their decision,” Mr. Mix explained.

“Restoring the personal freedom of millions of American employees is the direct and primary purpose of H.R.1200 and S.532.

“To do this, it isn’t necessary to add a word to federal law.

“And not just cost of living-adjusted per capita personal income, but also an array of other major measures of prosperity and growth, indicate that enactment of Wilson-Paul would benefit employees economically even as it protects their freedom of association.”

This article was originally published in our monthly newsletter. Go here to access previous newsletter posts.

To support our cause and help end forced unionism, go here to donate.

Big Labor abuse of worker pension and benefit funds as a means of advancing union bosses’ self-aggrandizing policy objectives is a familiar phenomenon.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

What impact does handing a union monopoly power to deal with your employer on matters concerning your pay, benefits, and work rules have on your pay?