Real Incomes Higher in Right to Work States

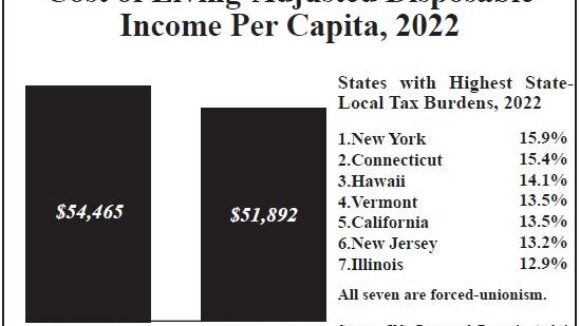

One reason why spendable income is higher in Right to Work states is forced-dues states’ substantially higher state-local tax burdens.

One reason why spendable income is higher in Right to Work states is forced-dues states’ substantially higher state-local tax burdens.

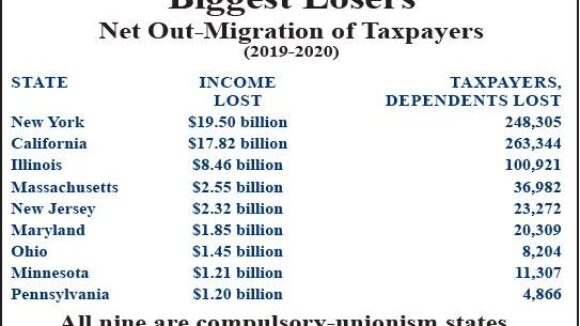

Recently released data from the IRS indicate the cost of forced unionism soared by more than 50% in the Tax Filing Year 2019, as compared to the year before.

"A net total of roughly 212,000 tax filers moved from a forced-unionism state to a Right to Work state between 2018 and 2019."

The average resident of a Right to Work state is spending two weeks less time this year laboring to pay off his or her total tax burden than is the average compulsory-unionism state resident. This Year, Right to Work ‘Tax…

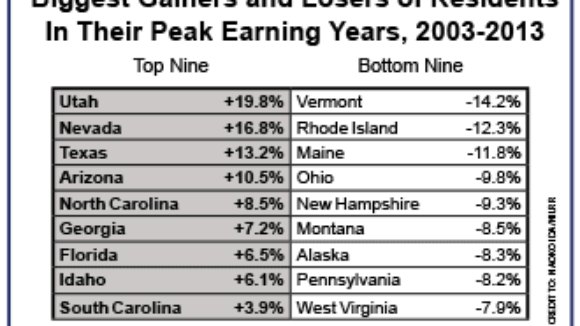

Number of 35-54 Year-Olds in Forced-Dues States Falling Sharply (Article first appeared in the September 2014 National Right to Work Committee Newsletter) Because, as a group, they already have plenty of work experience, but…