January 2019 National Right To Work Newsletter Summary

Here is where you can find a pdf of the January 2019 National Right To Work Newsletter

Here is where you can find a pdf of the January 2019 National Right To Work Newsletter

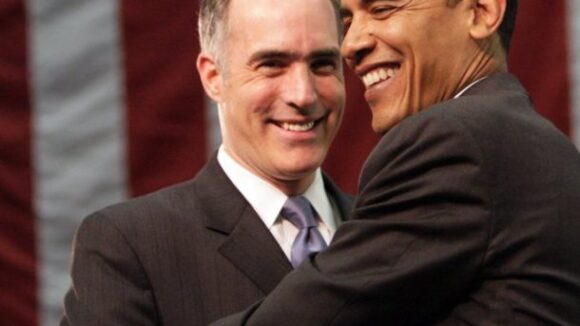

In this year’s elections, Bob Casey (D-Pa.) (pictured with former President Barack Obama) and a number of other Big Labor senators will have to answer for their votes to perpetuate federally imposed force unionism. CREDIT MEDIA.PENNLIVE.COM National Right to Work…

Mark Mix: Forced unionism is "an economic albatross for many states and for America as a whole." Credit FOXBusiness.com National Right to Work Law Could Finally Stop the Hemorrhaging (Source: January 2012 National Right to Work Committee Newsletter) Perhaps the single most effective tool for measuring the long-term, ongoing migration of taxpayers and income out of forced-unionism states and into Right to Work states is furnished by the Statistics of Income (SOI) division of the IRS. And today any interested person can easily access SOI data through a data bank maintained on the web site of the Washington, D.C.-based Tax Foundation. Forced-Unionism States Are Losing Massive Amounts of Income as Well as People The SOI records the number of personal income tax filers who move (typically with their dependents, if they have any) across state lines, based on address changes shown on individual tax returns. The SOI data are arranged according to the year taxes are filed. For example, data for the Tax Filing Year 2010 show that a total of 1.35 million personal income tax filers were residing that year in a Right to Work state after residing somewhere else in the U.S. the previous year.

(Source: September 2010 NRTWC Newsletter) Since forced-unionism cheerleader Barack Obama became President in January 2009, Big Labor bosses and their yes-men in the U.S. Congress have helped him inflict a lot of damage on employees, businesses, and taxpayers across America. To take just the latest example, last month union puppet politicians in the Senate and House rubber-stamped a special-interest measure (H.R.1586) that will ultimately extract an additional $10 billion from beleaguered private-sector employees and businesses to maintain and expand wasteful unionized government payrolls. From 1998 to 2007, the number of instructional employees at K-12 public schools nationwide soared by 15.9% -- an increase 3.5 times greater than the 4.5% growth in school enrollment over the same period. The rapid-fire expansion of school payrolls, roughly 70% of which are unionized, produced no measurable improvement in educational outcomes, but cost taxpayers tens of billions of dollars. And the terms on which H.R.1586 piles on another $10 billion are expressly designed to ensure that currently strapped states do not pare back the past decade of teacher union boss-driven growth in K-12 payrolls in order to avoid increasing the burden on taxpaying individuals and businesses. On August 11, just one day after the House had okayed H.R.1586, President Obama signed it into law. Big Labor Bosses Still Far From Satisfied

(Source: September 2010 NRTWC Newsletter) Since forced-unionism cheerleader Barack Obama became President in January 2009, Big Labor bosses and their yes-men in the U.S. Congress have helped him inflict a lot of damage on employees, businesses, and taxpayers across America. To take just the latest example, last month union puppet politicians in the Senate and House rubber-stamped a special-interest measure (H.R.1586) that will ultimately extract an additional $10 billion from beleaguered private-sector employees and businesses to maintain and expand wasteful unionized government payrolls. From 1998 to 2007, the number of instructional employees at K-12 public schools nationwide soared by 15.9% -- an increase 3.5 times greater than the 4.5% growth in school enrollment over the same period. The rapid-fire expansion of school payrolls, roughly 70% of which are unionized, produced no measurable improvement in educational outcomes, but cost taxpayers tens of billions of dollars. And the terms on which H.R.1586 piles on another $10 billion are expressly designed to ensure that currently strapped states do not pare back the past decade of teacher union boss-driven growth in K-12 payrolls in order to avoid increasing the burden on taxpaying individuals and businesses. On August 11, just one day after the House had okayed H.R.1586, President Obama signed it into law. Big Labor Bosses Still Far From Satisfied

The Congress and the White House have worked together to give union bosses bailouts and handouts to the extent we have never seen. But there appears to be no end in sight. Sen. Bob Casey (D-PA) has…

Legislation introduced last week could shift costs of union pension plans to taxpayers in an attempt to stave off organized labor’s pension funding crisis. Senator Bob Casey, Pennsylvania Democrat, introduced the so-called …