Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

National Right to Work Law Could Finally Stem the Out-Migration

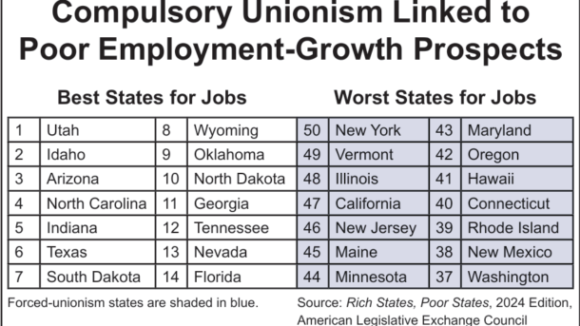

For decades, millions of hardworking taxpayers residing in slow-growth forced-unionism states have been seeking and finding opportunities to provide better lives for themselves and their families by relocating to faster-growth Right to Work states.

Unfortunately, journalists and scholars have so far paid little attention to this secular trend in domestic migration.

Perhaps the single most effective tool for measuring the long-term, ongoing migration of taxpayers and incomes out of forced-dues states is furnished by the Statistics of Income (SOI) division of the IRS.

Each Tax Filer Loss Cost Forced-Dues States an Average of $68,760

And today, any interested person can easily access SOI data on the “State to State Migration Data” page of the web site of the Washington, D.C.-based Tax Foundation or the How Money Walks web site, maintained by financial writer Travis Brown.

The SOI division records the number of personal income tax filers who move (typically with their dependents, if they have any) across state lines, based on address changes shown on their tax returns.

The SOI data are arranged according to the year taxes are filed.

For example, the most recent available annual data (for the Tax Filing Year 2015) show that a total of nearly 1.31 million tax filers were residing in a Right to Work state that year after residing somewhere else in the U.S. the previous year.

(Since the bans on compulsory union dues and fees in West Virginia, Kentucky and Missouri, the three most recent states to enact Right to Work laws, were all adopted since the beginning of 2016, they are regarded as forced-dues states in this analysis.

Wisconsin, whose Right to Work law was adopted in 2015, is excluded.)

Meanwhile, roughly 1.19 million tax filers were residing in a Right to Work state in 2014, but filed from somewhere else in the U.S. in 2015.

That means a net total of roughly 117,000 tax filers moved from a forced-unionism state to a Right to Work state between 2014 and 2015.

The SOI division also calculates and makes public the aggregate adjusted gross incomes for tax filers in the year immediately following their move from one state to another.

Personal income tax filers moving out of a forced-unionism state between 2014 and 2015 reported a total of $86.0 billion in income in 2015, or $68,760 per filer. Tax filers moving into a forced-unionism state reported a total of $69.3 billion in income, or $60,943 per filer.

From 2014 to 2015, Forced-Dues States Lost $16.7 Billion in Income Due to Out-Migration

Both because of their substantial taxpayer losses due to net domestic out-migration, and because the taxpayers they gained reported $7817 less income apiece than the taxpayers they lost, compulsory-unionism states lost $16.7 billion in adjusted gross income in a single year.

Moreover, all of the nine states suffering the worst net losses of income, in absolute terms, due to taxpayer out-migration from 2014 to 2015 lack Right to Work laws. (See the chart on this page for additional information.)

This was no isolated occurrence.

The SOI’s migration data going back to the 1991 Tax Filing Year (the first year for which such data are available) consistently show forced-unionism states losing billions of dollars a year in income due to taxpayers’ and their families’ “voting with their feet” in favor of Right to Work.

It now seems highly probably that forced-unionism states’ aggregate losses over the course of the current decade will be far greater than the $137 billion (in constant 2010 dollars) they lost due to domestic out-migration during the first decade of the millennium.

Financial Cost Suffered by Big Labor-Ruled States Compounds Every Year

And the migration data furnished by the IRS do not convey how much taxpayers who flee forced-unionism states earn any later than the first year after they depart.

But the financial cost endured by Big Labor-ruled states is clearly compounding, as well as recurring, year after year.

From 2013 to 2014, net domestic out-migration cost forced-unionism states (including Wisconsin) a total of $18.5 billion in adjusted gross income.

Counting just the income lost in the first year after each tax filer moves out, forced-unionism states will lose an estimated $157 billion due to domestic out-migration during the Tax Filing Years 2011 through 2020.

The actual net loss over the decade, including income reported by taxpayers in all years subsequent to their migration, will very likely be at least four times higher, but cannot be calculated with available data.

Power to Withhold Union Dues From Big Labor Critical For Workers

State Right to Work laws protect employees’ freedom to refuse to pay dues or fees to an unwanted union. Wherever employees lack this freedom, union bosses have little incentive to tone down their class warfare in the workplace.

Employees are consequently far less likely to reach their full productive potential.

“Compulsory unionism is wrong, plain and simple,” affirmed Mark Mix, president of the National Right to Work Committee.

“It is also an economic albatross for America as a whole as our nation strives at last to emerge from more than a decade of recession and sluggish growth.”

Entire Country Suffers Severe Damage Due to Forced-Dues Politicking

Mr. Mix explained that, while states that fail to shield employees from federal pro-forced unionism policies are harmed most of all, the entire country suffers severe damage:

“The union-label politicians who regularly get elected and reelected because of Big Labor’s forced dues-funded support overwhelmingly favor higher taxes and more red-tape regulation of business.

“This is true at the federal, state and local levels. Private-sector job growth in all 50 states, including Right to Work states, is hindered by the actions of Big Labor politicians.”

To end the abuse of independent-minded employees and the economic wreckage wrought by compulsory unionism, the Committee is backing legislation (S.545 and H.R.785) that would eliminate from federal labor law all provisions authorizing forced dues and fees.

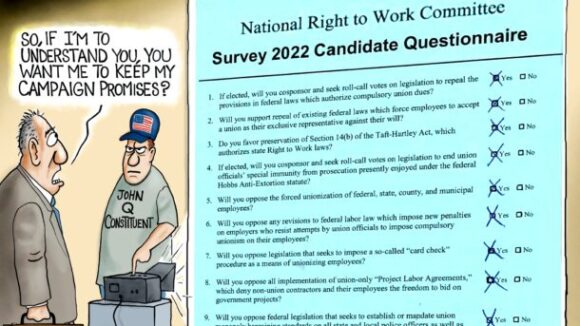

Recorded Votes Help Pro-Right to Work Citizens Turn Up the Heat on Big Labor Politicians

At this time, the Committee is pushing hard for recorded votes on Right to Work legislation in both chambers of Congress.

“Because the Committee and then-Sen. Jim DeMint [R-S.C.] successfully pressed for a floor vote on forced-dues repal in 2009, some Big Labor senators seeking reelection this year like Pennsylvania Democrat Bob Casey will be feeling the heat from their constituents for opposing Right to Work,” said Mr. Mix.

“If Senate Majority Leader Mitch McConnell [R-Ky.] and House Speaker Paul Ryan [R-Wisc.] now allow recorded floor votes on forced-dues repeal, pro-Right to Work citizens across the country will know which of their federal politicians support employees’ personal freedom of choice, and which are Big Labor stooges.

“Poll after poll shows nearly 80% of Americans who regularly vote in federal elections support the Right to Work principle.

“Recorded congressional votes now, even if unsuccessful, will advance the Right to Work cause by letting millions of grass-roots supporters know whether or not their senators and House members are on their side.

“That’s why the Committee will continue to mobilize members nationwide to contact Mr. McConnell and Mr. Ryan and ask them to bring up S.545 and H.R.785 for floor votes as soon as they reasonably can.”

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

Members Insist They Keep Pro-Right to Work Campaign Promises