Grocery, Prescription Drug, Electricity Prices Will Be Jacked Up

As this Newsletter went to press, union lobbyists were furiously twisting arms to secure sufficient Capitol Hill support to send a federal budget package foisting an estimated $3 trillion of new or higher taxes on American employees, business owners and savers to Big Labor President Joe Biden’s desk.

Roughly two-thirds of the $3 trillion bonanza is projected to come from union-label Democrat politicians’ proposed 26% increase in the marginal tax rate and other assorted tax hikes for thousands and thousands of U.S.-based companies that sell basic items purchased by all kinds of Americans.

Those include even food, medicines and energy.

Federal Reserve Study: Tax Hikes on Businesses ‘Uniformly’ Harm Workers

As competent economists of all stripes recognize, the burden of Mr. Biden’s estimated $2 trillion in business tax increases will fall most of all on employees and other consumers of groceries, prescription drugs and electricity, to take just a few examples.

A 2016 Federal Reserve Board study, for example, concluded that tax increases on incorporated businesses are “uniformly harmful to workers.”

The Federal Reserve study specifically shows an increase in the federal marginal tax rate for such businesses to 26.5%, as Big Labor politicians are proposing, “could cost a household earning $85,000 nearly $3,000 a year in lower wages,” according to former Treasury Assistant Secretary Bruce Thompson.

In a September 22 op-ed for the Washington Examiner, Mr. Thompson also cited a study by the National Association of Manufacturers (NAM) showing that the higher taxes on U.S. firms with domestically located facilities proposed by Joe Biden and his cohorts “would lead to major job losses for workers.”

The spring 2021 NAM study projected that the Biden tax increases would wipe out a million jobs in the first two years and “500,000 jobs each year for the next decade.”

Big Labor Spends ‘Liberally,’ Lobbies ‘Fiercely,’ on Tax Hike’s Behalf

Even though the mammoth Biden tax-hike-and-spending package would raise prices, lower pay, and decrease job opportunities for the employees they purport to represent, union bosses are determined to see it become law.

The lead sentence of a September 20 report by Politico’s Eleanor Mueller nicely summed up Big Labor’s lobbying blitz on the scheme’s behalf:

“Unions are spending liberally and lobbying fiercely in an effort to get Democrats’ multitrillion-dollar [tax and] social spending package across the finish line.”

This fall, countless union officials whose pay, benefits, and work expenses come straight out of forced-dues-laden union treasuries have devoted most or all of their professional time to rounding up Capitol Hill votes for this package, which Big Labor bosses by their own admission helped write.

Top union bosses are simultaneously pouring millions and millions of dollars in cash into advertising in support of the Tax & Spend package.

For example, as Ms. Mueller reported, the Service Employees International Union (SEIU) hierarchy announced September 14 “that it is doubling the amount of money it’s spending on TV and digital ads from $3.5 million to $7 million.”

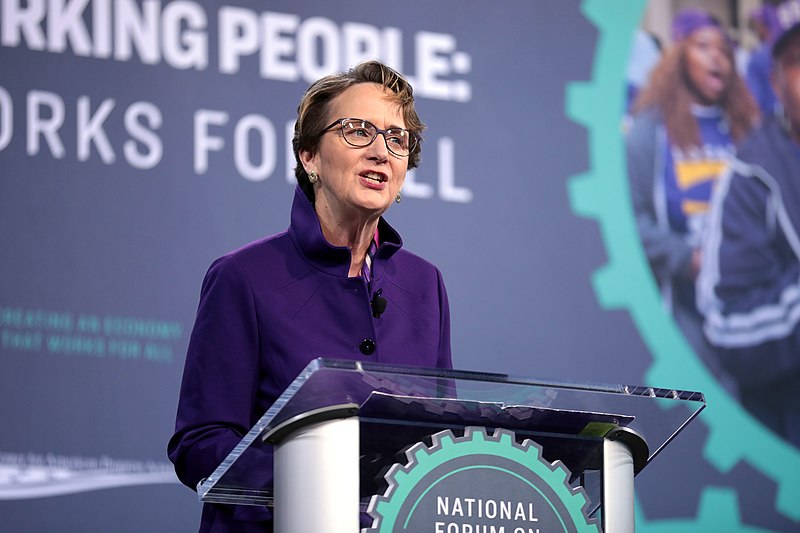

“We’re going to fight like h*** in this homestretch” boasted SEIU President Mary Kay Henry to Politico.

Grants to Direct Care Workers Conditioned on Going Through Big Labor Indoctrination

Big Labor radicals like Ms. Henry are “fighting like h***” for enactment of the multitrillion-dollar Tax & Spend scheme for a host of reasons.

To start with, union strategists have successfully inserted in the budget reconciliation bill several key provisions from Big Labor’s so-called “Protecting the Right to Organize” (“PRO”) Act (S.420/H.R.842), a smorgasbord of special privileges for union bosses that is currently stalled in Congress.

(For a discussion of one especially outrageous example, see the cover story of this Newsletter edition.)

The Biden budget also includes a host of spending provisions that collectively deploy billions and billions of taxpayer dollars to promote monopolistic and compulsory unionism.

One such provision that is especially valuable to the SEIU brass would furnish grants to employers of direct-care workers to help them meet their payrolls, but only if the employees of grant recipients receive “training” on the supposed benefits of unionization.

To receive the direct-care grants, employers would also have to promise not to talk to their employees about any of the potential downsides of unionization.

Reconciliation Fight Underscores Need For National Right to Work Law

National Right to Work Committee President Mark Mix commented:

“If the Biden Fiscal 2022 budget is adopted in anything like its current form, passage will constitute the biggest forced-unionism victory in Washington, D.C., in decades.

“To defeat this legislation, or at least to strip it of its most dangerously anti-worker provisions, the Committee is now mobilizing grassroots citizens across the country.

“Mounting public opposition from Right to Work supporters and other concerned Americans has already slowed down Big Labor House Speaker Nancy Pelosi [D-Calif.] and Senate Majority Leader Charles Schumer’s [N.Y.] efforts to ram budget reconciliation through Congress.

“Despite Big Labor bosses’ cold-blooded determination to see this scheme become law, there is now a growing possibility it can be stopped.”

Mr. Mix added:

“Regardless of the ultimate outcome of the reconciliation battle, it underscores the need for national Right to Work legislation empowering millions of private-sector employees to refuse to bankroll unions that don’t speak for them.

“This fall, radical union bosses like Mary Kay Henry are shoveling workers’ forced-dues money into a blitz to enact a Tax & Spend scheme that will lower real, spendable incomes and wipe out good-paying jobs for ordinary Americans.

“But once the National Right to Work Act [S.406 and H.R.1275] becomes law, no employees will be forced to pay dues or fees to the SEIU or any other union simply in order to keep their jobs and provide for their families.

“Thanks to Committee members’ efforts, the Right to Work Bill now has a total of 110 congressional sponsors. And Committee legislative staffers are currently looking for an opportunity to bring this legislation up for a congressional floor vote.”

This article was originally published in our monthly newsletter. Go here to access previous newsletter posts.

To support our cause and help end forced unionism, go here to donate.