Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

Unchaining Employees Can Save Illinois, Connecticut, New Jersey

For years, government union monopolists have been ripping off ordinary, hardworking taxpayers in Illinois, Connecticut and New Jersey — all states where both private- and public-sector employees may be forced to pay Big Labor dues or fees as a job condition — in a host of ways.

Meanwhile, economic growth in the Prairie, Nutmeg and Garden States has been abysmally slow.

This summer, budgetary problems in all three states escalated.

States Are ‘Prime Examples’ Of Monopolistic Unionism’s Fiscal Consequences

Illinois avoided having its bonds downgraded to “junk” status only by foisting an across-the-board 32% increase on state income-tax payers. Connecticut’s capital, Hartford, hired a bankruptcy attorney. And New Jersey’s government had to shut down for three days.

“Illinois, Connecticut, and New Jersey, along with insolvent Puerto Rico, are today’s prime examples of the dire fiscal consequences of monopolistic unionism in our country,” commented National Right to Work Committee President Mark Mix.

“But a number of other Big Labor-controlled states are also headed toward budget breakdowns.”

During the first week in July, the Big Labor Democrat-ruled Illinois Senate and House voted to override a veto by GOP Gov. Bruce Rauner and adopt a budget that raises taxes on Illinois households and businesses by a whopping $5 billion.

Nearly 40% of Illinois State ‘Education’ Budget Goes Toward Public Pensions

A total of 11 union boss-appeasing Republican legislators in both chambers banded together with Tax-and-Spend Senate Majority Leader John Cullerton and Speaker Michael Madigan (both D-Chicago) to ram through their budget scheme.

While Mr. Cullerton, Mr. Madigan and other likeminded political insiders insist that imposing massive new burdens on already overburdened employees and businesses was the “fiscally responsible” thing to do, they refuse to take any meaningful steps to address the root causes of Illinois’s fiscal mess.

As a July 5 Wall Street Journal editorial pointed out, payments to pension funds for overwhelmingly unionized state and local government employees will consume roughly a quarter of Illinois’ general fund this year.

And nearly 40% of the Illinois government’s K-12 “education” budget actually goes toward pensions for unionized government school employees.

Despite these massive outlays of taxpayer dollars on government pensions, Moody’s Investors Service reports that Illinois’ unfunded pension liabilities are continuing to rise, year after year, and now total an estimated $251 billion.

“The deadly combination of state Supreme Court rulings that effectively make it impossible for lawmakers to modify government employee pension benefits before they are even earned, and union monopoly bargaining, has made it seemingly impossible to get public spending in Illinois back under control,” said Mr. Mix.

Connecticut Sales, Corporate Tax Revenue Projected to Fall By $450 Million This Year

If the experience of Connecticut, whose legislators incrementally jacked up their state’s top income-tax rate from 5.0% to 6.99% between 2009 and this year, is any indication, the new Illinois tax hike might even result in lower revenue.

The Connecticut General Assembly’s Office of Fiscal Analysis recently downgraded projected state income-tax revenues for this year by $1.1 billion. Sales and corporate tax collections are now expected to fall by $450 million.

On July 6, Hartford, the Nutmeg State’s capital and its third-largest city, announced it had hired Greenberg Traurig LLP, a legal practice specializing in bankruptcies, to help elected officials explore their options.

With taxes already exorbitantly high (for example, the annual property assessment on a $300,000 home in Hartford is nearly $22,300) and expenditures on core services already slashed to enable the city to meet its soaring payroll costs, Democrat Mayor Luke Bronin and the city council are in a tight spot.

State law effectively prevents them from doing anything to stem the growth of payroll costs without the permission of union bosses or arbitrators who have a flagrant bias in favor of Big Labor.

“Right now, from a fiscal standpoint, you have a capital city fighting with its hands behind its back,” lamented Mr. Bronin this spring.

New Jersey’s Long-Term Liabilities Represent 360% of Its Total Assets

Cash-strapped New Jersey now has so little money available to cover its rapidly expanding health-care costs that union boss-appeasing GOP Gov. Chris Christie recently concocted a scheme to force nonprofit health insurer Horizon Blue Cross Blue Shield (HBCBS) to finance roughly $300 million in medical services for free.

When legislators, evidently fearing a backlash from HBCBS policy holders, refused to go along, Mr. Christie allowed the state government to shut down temporarily in early July.

While the temporary closure of New Jersey state parks and beaches made national headlines, it was a minor matter compared to the fiscal nightmare that is rapidly approaching.

According to a new analysis by the nonpartisan Mercatus Center, a think tank affiliated with George Mason University in Virginia, New Jersey’s long-term liabilities now represent 360% of its total assets.

That amounts to $16,821 per capita, a long-term liability problem more severe than that of any other state.

Right to Work Supreme Court Case Could Be Catalyst For Reform

Mr. Mix commented:

“The statutory forced-dues and monopoly-bargaining privileges wielded by government union kingpins in Illinois, Connecticut and New Jersey have transformed them into such formidable political players that it’s almost impossible to imagine a brighter future for these states’ ordinary citizens.

“But a legal case that could be taken up by the U.S. Supreme Court during its 2017-18 term has the potential to loosen substantially union officials’ stranglehold over lawmakers in Springfield, Hartford and Trenton.

“On June 6, Illinois civil servant Mark Janus asked the High Court to hear a case he has so far pursued in federal district and appellate courts challenging the constitutionality of forced union dues and fees as a condition of public employment.

“Mr. Janus is being represented by staff attorneys for the National Right to Work Legal Defense Foundation, the Committee’s sister organization, and the Liberty Justice Center in Chicago.

“Janus v. AFSCME seeks to overturn the High Court’s 1977 decision in Abood, which held that, even though forcing public employees to subsidize union-boss advocacy on workplace issues infringes their First Amendment rights, such infringement is permissible because it purportedly helps maintain ‘labor peace.’”

Inordinate Power to Block Changes in How Workers Are Compensated Would Erode

“At the same time,” Mr. Mix continued, “Abood held that, under the First Amendment, government union officials may never force objecting union nonmembers to bankroll Big Labor political and ideological advocacy.”

Mr. Janus and his attorneys contend the distinction Abood attempted to make between (permissible) forced speech on workplace matters and (impermissible) forced speech on political matters is untenable.

They urge the High Court to relieve public employees of the obligation to subsidize any kind of Big Labor advocacy.

If they prevail, and government union kingpins in states like Illinois, Connecticut, and New Jersey are stripped of their power to collect forced dues and fees, union bosses’ inordinate power to block common-sense reforms in the way public employees are compensated will “erode over time,” predicted Mr. Mix.

“Of course,” he cautioned, “the benefit will be relatively limited unless state lawmakers, with grass-roots citizens’ help, follow up by curtailing government union bosses’ monopoly-bargaining power over employee pay, benefits and work rules.

“But the Janus case could provide the Prairie, Nutmeg and Garden States with a real opportunity to emerge from their fiscal morass.”

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

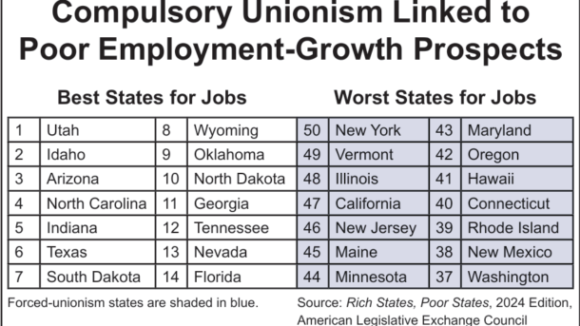

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

Members Insist They Keep Pro-Right to Work Campaign Promises