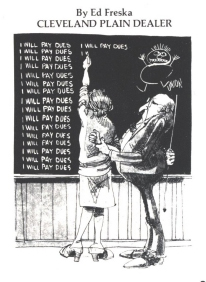

Teacher's Union Bosses: 30% More Taxpayer Money and Less Work or We Strike!

Teacher's in Chicago, Illinois have voted to authorize a strike over their demand for a 30% pay increase (funded by the taxpayers) and smaller classroom sizes. The union wants a two-year deal that reduces class size and calls for teachers to receive a 24 percent pay raise in the first year and a 5 percent pay raise in the second year. The strike would start at the beginning of the next school year should the union not come to terms with Mayor Rahm Emanuel. With their neighbors on one side in Indiana enacting a Right to Work statute and their neighbors on the other, in Wisconsin, enacting reforms to save taxpayers money, it is clear Big Labor in Illinois hasn't gotten the message. Taxpayers want reform, choice, efficiency and freedom. That message will take root in Illinois soon. Emanuel spokeswoman Sarah Hamilton said the public schools cannot afford a strike. "At a time when our graduation rates and college enrollments are at record highs – two successes in which our teachers played an integral role – we cannot halt the momentum with a strike," she said. "Our teachers deserve a raise, but our kids don't deserve a strike and taxpayers cannot afford to pay for 30 percent raises." You might remember this video from a previous Chicago/Illinois Teachers Union staged event titled "Give up the bucks!"