Redistribution, Big Labor style

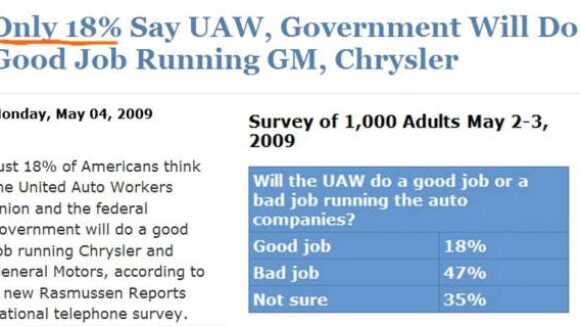

[media-credit name=" " align="alignright" width="300"][/media-credit]The Obama administration's Delphi debacle -- when union members were made whole at the expense of non-union workers -- continues to hound the White House. The Free Beacon looks at the scandal:

Fred Arndt and his brother Dave came to General Motors straight out of high school.

They spent their entire careers building the engine cooling systems that increase the lifespan of Cadillacs and other vehicles. Dave worked in assembly; Fred, one year younger, qualified for GM University, which propelled him to work as a draftsman and engineer. They worked the line side-by-side. Dave built the parts Fred had designed.

The brothers made their way to Delphi, an auto supplier spun off from GM that builds components—seats, instrument panels, steering and suspension systems—for cars.

After more than 30 years with the company, the brothers retired in their native Michigan. They watched as Delphi’s growing labor costs dragged it into Chapter 11 bankruptcy in 2005. It would not emerge until 2009 when the government stepped in with $50 billion for GM.

And then the Arndt brothers’ paths diverged. Fred, 64, lost his health, dental, and life insurance, along with 70 percent of his pension. Dave lost five percent of his health insurance and some dental coverage…

…[Fred] Arndt is one of the more than 20,000 non-union Delphi employees that have seen their pensions wiped out by the government-directed bankruptcy. While the pension fund covered the retirement packages of executives, the majority of employees are middle class white-collar workers: engineers, accountants, and secretaries.