Next Government Union Bailout Can Be Stopped

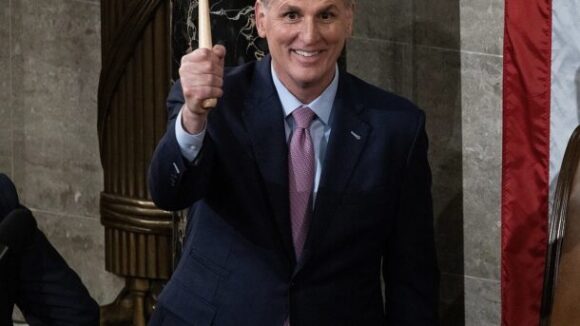

Speaker Kevin McCarthy has vowed that the House will “use the power of the purse” to “check” Big Labor President Joe Biden’s policies.

Liz Peeks discovers the nasty truth of the Obama auto bailouts — they were a “Hefty Union Payoff”:

[media-credit name=”NRTW Committee®” align=”alignright” width=”300″] [/media-credit]

[/media-credit]

In the second presidential debate, Mr. Obama attacked early on, saying, “Governor Romney said we should let Detroit go bankrupt.”

Note to Obama fans: GM did go bankrupt – filing for Chapter 11 protection against its creditors on June 1, 2009. It’s what happened next that the president can take credit for – a handout of $49.5 billion in taxpayer money to GM, some $27 billion of which remains outstanding, and another $17 billion to its financial arm Ally Financial, which still owes $14.7 billion.

In other words, Obama didn’t save General Motors; American taxpayers did, with an assist from the Federal Reserve. While liberals rant about the bailouts of Wall Street, it is worthwhile noting that of the $417 billion in TARP funds spent to stabilize the economy, only $65 billion has yet to be repaid – and more than half of that is owed by GM and Chrysler. The latest TARP report from the Congressional Budget Office says that the government invested nearly $80 billion in those two auto giants and that taxpayers are still on the hook for roughly $37 billion.

In the same report, the CBO projects that handouts to Wall Street firms will ultimately net the government a cool $11 billion profit. They say the auto industry, on the other hand, will never pay back taxpayers. According to the congressional bean counters, $20 billion is gone for good.

Where did that money go? Mainly, it went to paying off debts owed by GM and Chrysler, and – in an historic distortion of our bankruptcy proceedings – to securing the pensions and livelihoods of UAW workers. It turns out the real debt was that of Mr. Obama to organized labor, which had ponied up some $400 million to help him defeat John McCain.

The Obama administration strong-armed the auto companies’ creditors into accepting undeniably unfair terms – terms that saw pensions obliterated for non-union workers but saved for those carrying a UAW card. Terms that saw non-UAW shops close but UAW factories stay open. Terms that doled out ownership in GM with political favoritism as a guiding principle.

These charges are not at issue. In the government-managed reorganization of GM, bond holders (secured bond holders, who normally are at the top of the pay-out chart) were given equity in the carmaker at a price of $2.7 billion per one percent ownership. The government ended up paying $834 million for every one percent it claimed; the UAW paid only $629 million.

Why did the UAW receive such favorable treatment? The government at the time argued that the UAW was already making sufficient sacrifices. While true that union members gave up cost-of-living increases and agreed to a no-strike rule, they were protected against the kind of pay cuts that would have made GM truly competitive.

Months earlier, Congress refused an emergency loan to the auto makers because the UAW would not lower pay to compete with foreign car makers operating in non-unionU.S. factories. The reality is that the UAW could have been harder pressed. If GM and Chrysler had stopped turning out cars, the union was toast.

It was not only the ownership share that was skewed towards the UAW. As jobs began to come back, it was the UAW plants that kicked into high gear. Workers at GM’s plant in Moraine,Ohio, who had been laid off in 2007, were not included in the re-hiring. Why? Because they did not belong to the UAW. The Moraine plant was reportedly one of GM’s most productive, but under the terms of GM’s reorganization, its workers were “banned from transferring to other plants,” according to Sharon Terlep at The Wall Street Journal.

Moraine was not the only non-UAW facility to fall under the knife; a truck plant in Ontario organized by the Canadian Auto Workers also went down.

The treatment of laid-off workers was not the only favor dealt the UAW. In a growing scandal, Obama’s former auto czar and two Treasury officials appear implicated in the decision to eliminate the pensions of 20,000 non-union workers at GM’sDelphi unit, while protecting benefits for UAW members. Under oath, they blamed the decision to wipe out the nonunion pensions on the Pension Benefit Guaranty Corporation, but emails uncovered earlier this year show that Treasury held meetings on the matter in which the PBGC was not included.

The auto task force individuals involved have stonewalled Congress and SIGTARP investigators looking into the matter.

With tens of billions still at stake, taxpayers may wonder, is GM healthy? Certainly the company has staged a comeback. Its costs were indeed lowered, in large part because its debt burden was eased. It is not clear that the structural overhang of overly generous benefits and wages has entirely disappeared. Sales today industry-wide are being boosted by record-low interest rates, thanks to Fed easing, and also by a slightly unnerving boom in subprime lending – especially at GM.

Through a recently-acquired financing arm, GM subprime loans have accounted for a growing share of total sales – from 4.8 percent in late 2010 to 8.2 percent early this year. The industry average is around 6 percent. Some have charged the firm with hyping sales in order to boost its share price. The stock is currently selling at around $25; only as it moves closer to the breakeven price of $54 is there any chance that the government will sell its shares. Management has complained that being known as Government Motors inhibits hiring; they would like Uncle Sam out of the way. The Obama White House, however, is not about to unload the shares at current levels, broadcasting the resulting losses for the world to see.

Mitt Romney, for the record, advocated for a process not unlike the one that ultimately led to GM’s restructuring – absent the union giveaways. In his 2008 op-ed, which he titled “The Way Forward for the Auto Industry” but which The New York Times published as “Let Detroit Go Bankrupt,” Romney calls for new labor agreements to make domestic car companies competitive, noting the $2,000 per vehicle cost disparity between US makers and their overseas rivals.

He pushed for a change in management, improved relations between labor and the bosses, which might be helped by getting “rid of the planes, the executive dining rooms,” as well as profit sharing or stock grants, and called for investment in new technologies, “especially fuel-saving design.” Never could he have imagined that his thoughtful assessment of the industry’s future prospects could be held against him. But then, he might never have imagined a campaign so perilously built on distortions and half-truths, and so eager to run away from the reality of the past four years.

Speaker Kevin McCarthy has vowed that the House will “use the power of the purse” to “check” Big Labor President Joe Biden’s policies.

Biden's $36 billion bailout incentivizes irresponsible union pension fund management and hurts taxpayers

An opportunity looms for President Trump to save taxpayers billions. Will he seize it? Credit: AP file photo Union Bosses Poised…