Union Bosses Hate Gov. Walker For His Success

The Investors Business Daily nails it -- the union bosses hate and fear Wisconsin Gov. Scott Walker because his plan is working and is a model for other states seeking to balance their budgets:

Backed by a massive, well-financed Big Labor machine, the Democratic Party is determined to reverse the democratic election of Wisconsin Republican Gov. Scott Walker. His crime? Fixing his state's economy.

Democrats and their powerful [forced-dues funded] union allies got the more than half a million signatures needed to hold a recall ballot intended to remove Walker, a Republican elected in November 2010. The vote will be in just over two months.

Or did they? "Adolf Hitler" and "Mick E. Mous" were successfully weeded out — plus tens of thousands of other invalid entries. But ABC-TV's Milwaukee affiliate was told by a man on the street that "I think I signed about 80 times" over two weeks.

How many others like him were there?

There have been two successful recall movements in American history. California Gov. Gray Davis, responsible for California's unprecedented electricity crisis, was replaced by movie star Arnold Schwarzenegger in 2003. And 1921 saw the grass-roots ousting of North Dakota Gov. Lynn Frazier, whose state takeover of farm-related industries rendered the state bank insolvent.

[Unlike those recalls] The Wisconsin recall would undo the election not of someone who has been resoundingly successful, not who wrecked his state's economy.

[Forced-dues] muscle, not popular discontent, is driving this movement. On taking office, Walker made it clear he meant business and dared to squash the unholy trinity of Big Labor, politicians and money, which poses such a danger to the entire nation.

He had the guts to say, "Collective bargaining isn't a right; it is an expensive entitlement." Acting on that principle, Walker balanced a $3.6 billion budget deficit without raising taxes, reduced the tax burden on entrepreneurs, reformed regulation and instituted what he calls "the most aggressive tort reform in the country" against frivolous lawsuits targeting businesses.

Is it a coincidence that Wisconsin unemployment is its lowest since 2008?

Did Walker devastate state government? Quite the contrary. His clampdown on collective bargaining ended seniority and tenure for public school teachers, replacing them with hiring and firing — and pay — based on performance.

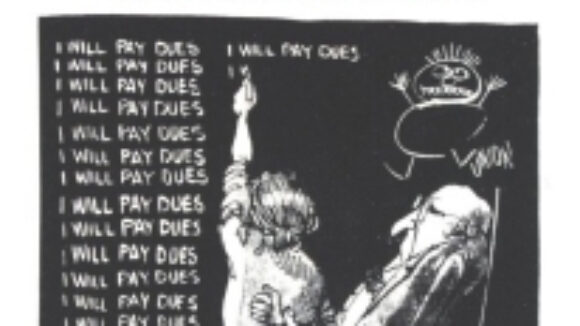

He gave each of the 300,000 Wisconsin state workers the right to choose on union membership — and financing Big Labor's political activities through dues.

Speaking before the Conservative Political Action Conference in Washington in February, Walker emphasized why he is being targeted: "The big government union bosses are worried that workers may actually choose to keep the money for themselves." This explains the tens of millions of dollars they spent last summer on six Wisconsin state Senate recall elections.