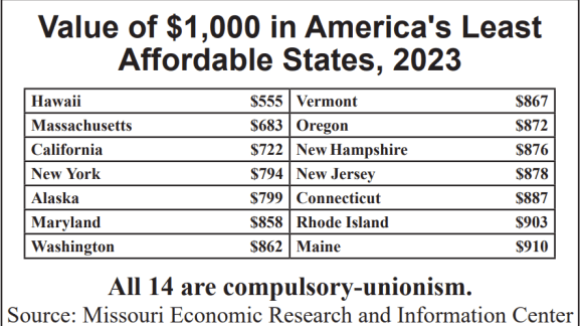

Banning Compulsory Dues Curbs Cost of Living

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

Parts of the Obama stimulus plan are being delayed by union rules and programs. Mickey Kaus reports that the home “weatherization” jobs in the stimulus bill were subjected to Davis-Bacon wage regulations — a favorite of the AFL-CIO Building and Construction Trades Department — under which federal Labor Department officials establish “prevailing wage” rates that must be paid. Why do unions like this system? Because the “prevailing wages” are determined in a way that guarantees they are more than the actual market wage, sometimes by large margins. All that finagling takes a certain amount of bureaucracy, however — and time. ABC’s Jonathan Karl: “According to the GAO report, the Department of Labor spent most of last year trying to determine the prevailing wage is for weatherization work, a determination that had to be made for each of the more than 3,000 counties in the United States. [E.A.]

As a result, the Department of Energy apparently weatherized only 22,000 homes under the program.”

Not only do these kickback rules slow progress, they often cancel it. Portsmouth, New Hampshire, turned down stimulus money for a new water treatment plant, because Davis-Bacon rules would have added $2.3 million to its $17.3 million price tag. Accepting the “stimulus” money would have meant a net loss for the city. [via NewsAlert]

On average, forced-unionism states are 23.2% more expensive to live in than Right to Work states. And decades of academic research show that compulsory unionism actually fosters a higher cost of living.

Big Labor Michigan politicians like Betsy Coffia arrogantly dismiss the expertise of independent-minded workers

Speaker Kevin McCarthy has vowed that the House will “use the power of the purse” to “check” Big Labor President Joe Biden’s policies.