Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

Victims Include Vehicle Owners, Policyholders, Online Shoppers

According to the nonpartisan, Washington, D.C.-based Tax Foundation, residents of forced-unionism Illinois have been forking over roughly 31% of their aggregate personal income this year in federal, state and local taxes.

The Tax Foundation’s analysis shows that the total tax burden per Illinoisan is higher than in 43 other states, including all 27 of the Right to Work states.

But Democrat Gov. J.B. Pritzker and other union-label politicians in the Prairie State insist Illinois taxpayers’ burden isn’t heavy enough.

And in June, Mr. Pritzker signed into law three Big Labor-backed budget bills that are projected to increase extractions from taxpayers by $4.7 billion a year once they are all in effect.

Practically Every Illinois Household Is Already Paying Higher Taxes

Just last year, while campaigning to become Illinois’s chief executive with Big Labor’s enthusiastic support, Mr. Pritzker gave his state’s citizens the false impression that only a relatively small number of high-income households would be directly targeted by his tax scheme.

“Of course, the actual package of 21 tax and fee hikes adopted in 2019 turns out to be very different from the 2018 campaign rhetoric,” commented National Right to Work Committee President Mark Mix.

“Practically all Illinois households, including households headed by unionized workers whose forced dues and fees bankrolled pro-Pritzker get-out-the-vote efforts across the state, are already paying higher taxes.

“For example, on July 1 the statewide gas tax doubled from 19 cents to 38 cents a gallon, making Illinoisans’ total gas-tax burden the second-highest in the nation. Automatic additional increases are projected to raise the gas tax by another 18% over the next six years.

“Vehicle registration fees for many drivers are going up by roughly 50%. And fees for owners of electric vehicles are going up by 1,400%, to $500 a year!

“Another hefty tax increase hits managed health-care insurance companies, who will often have no choice but to pass on the cost to consumers. Yet another requires that local sales taxes in addition to state sales taxes be automatically added on to the cost of online purchases made by Illinoisans.”

Moody’s Has Estimated Unfunded Pension Liabilities of Nearly a Quarter Trillion

Even as they increased Illinois taxpayers’ already heavy burden, Big Labor politicians continued, practically speaking, to ignore the single greatest problem facing their state: unfunded liabilities for the pensions of overwhelmingly unionized government employees.

Using a discount rate close to that used by corporations, Moody’s Investors Services has estimated that Illinois’s unfunded pension liabilities are currently $234 billion.

“Liabilities are growing despite enormous annual outlays by state taxpayers to shore up the pension funds,” said Mr. Mix.

“In FY 19, Illinois taxpayers contributed in excess of $10 billion, or more than a quarter of the state budget, to cover state-worker retirement debts.

“And the Illinois government projects that pension costs alone will continue to consume a full quarter of the dollars forked over by state taxpayers over the next 25 years.”

To Save the State, Big Labor Monopoly Privileges Must Be Revoked

The reality is even worse than that, according to an analysis this May by journalists Ted Dabrowski and John Klingner for WirePoints, a Wilmette, Ill.-based news and commentary outlet.

“When the state’s debt costs are more properly and honestly accounted for, Illinois ends up beyond crisis levels,” wrote Mr. Dabrowski and Mr. Klingner.

“It would take nearly half of Illinois’s [then] $38 billion budget to pay the true costs of the state’s retirements.

“Simply put, Illinois is insolvent under most realistic financial measures.”

“To salvage Illinois’s fiscal future,” said Mr. Mix, “it is absolutely necessary that, in the near future, public officials reform future accruals of government pension benefits for employees who have already been hired as well as for those who haven’t been hired yet.

“Already-earned benefits could be protected.

“Unfortunately, because of rulings by the Illinois Supreme Court, the people must first amend the state constitution to empower public officers to modify government pension benefits before they are even earned.

“And once the so-called ‘pension protection’ constitutional provision is amended, union bosses will still be able to wield their monopoly bargaining power under Illinois state law to block common-sense reforms in the way public employees are compensated.

“Therefore, to save Illinois, it will also be necessary for lawmakers to remove government union bosses’ monopoly-bargaining power over employee pay, benefits, and work rules.”

Given that Big Labor has dominated Illinois politics for decades, prospects for genuine, dramatic reforms in the state capital may seem slim, acknowledged Mr. Mix.

Janus Decision Threw Out A Lifeline to Fiscally Troubled States Like Illinois

Fortunately, just last summer, the U.S. Supreme Court threw out a lifeline to fiscally troubled Organized Labor stronghold states like Illinois, New Jersey and Connecticut with its landmark decision in Janus v. American Federation of State, County and Municipal Employees Council 31.

In Janus, the High Court ruled in favor of independent-minded Illinois civil servant Mark Janus. The case was argued and won by National Right to Work Legal Defense Foundation staff attorney William Messenger.

Janus determined that extracting forced fees for union advocacy from public employees as a job condition violates the First Amendment.

“This was primarily a victory for individual rights. Its potential impact on state budgets is also vast,” said Mr. Mix, who heads the Right to Work Foundation as well as the Committee.

“Although actual implementation of Janus is still a work in progress, and is going to require lots of determination, this decision is already giving lawmakers in state after state an opportunity to reassert control over public pension obligations and protect taxpayers.

“In Illinois, this could happen relatively soon, if voters reject the 60% hike in the state’s maximum income tax rate union-label legislators have put on the November 2020 ballot at Mr. Pritzker’s behest.

“If fed-up citizens refuse, come Election Day next year, to allow Springfield politicians to pile a massive personal income-tax hike on top of the $4.7 billion in new taxes and fees they have already adopted, it will send them a clear message:

“Out-of-control spending must be reined in, or basic public services will be threatened.

“With a catastrophe staring them in the face, at least a significant share of Illinois state legislators may recognize that the time is up for a number of erstwhile sacred cows, including government union bosses’ 36-year-old statutory monopoly-bargaining privileges.”

If you have questions about whether union officials are violating your rights, contact the Foundation for free help. To take action by supporting The National Right to Work Committee and fueling the fight against Forced Unionism, click here to donate now.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

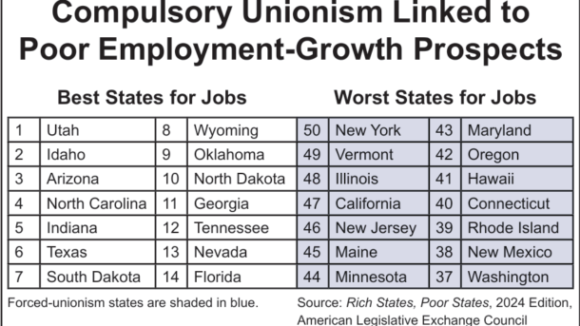

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

Members Insist They Keep Pro-Right to Work Campaign Promises