Union's Keep Pushing Taxes Higher in California

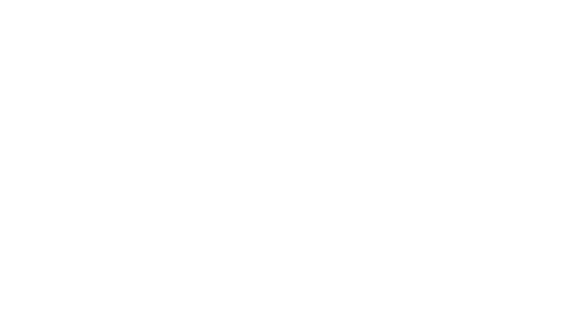

Who can forget the Chicago Teachers Union Activist above, but that attitude does not seem to be exclusive to Illinois. California Gov. Jerry Brown is pushing a new scheme to force tax increases on the taxpayers in the Golden State and not surprisingly, it is the teacher's union pushing the plan behind the curtain? From the OCRegister: Gov. Jerry Brown says the odds improved last week that voters will approve tax increases in November because he and the California Federation of Teachers merged their separate tax-raising schemes into one. This was not a compromise. Mr. Brown caved in to union pressure. Public employee unions were major financial backers of the governor's 2010 election campaign. In seeking huge tax increases to pay for government spending, he is doing unions' bidding. By merging initiatives, Mr. Brown agreed to reduce the increase he sought in the sales tax from a half cent to a quarter cent. But he agreed to seek a larger income-tax increase tax on more-affluent taxpayers. The new initiative would raise the top tax rate by 1 percent for those earning $250,000, 2 percent for incomes exceeding $300,000 and 3 percent on $500,000 and more. The state's top rate already is 10.3 percent, for those earning $1 million a year. The combined initiative is projected to raise $9 billion compared with the $7 billion the governor previously proposed. The tax increases would last seven years, rather than the previous five years.