Right to Work States "Tax Freedom Day" Arrives Earlier

(Click here to download the May 2014 National Right to Work Committee Newsletter) Households in High-Cost Forced-Unionism States ‘Get Socked Twice’ Early…

(Click here to download the May 2014 National Right to Work Committee Newsletter) Households in High-Cost Forced-Unionism States ‘Get Socked Twice’ Early…

Go here to read the May 2014 National Right to Work Newsletter and summary.

(Click here to download the April 2014 National Right to Work Committee Newsletter) Teacher Union Dons Eager to Hogtie Big Apple’s Charter…

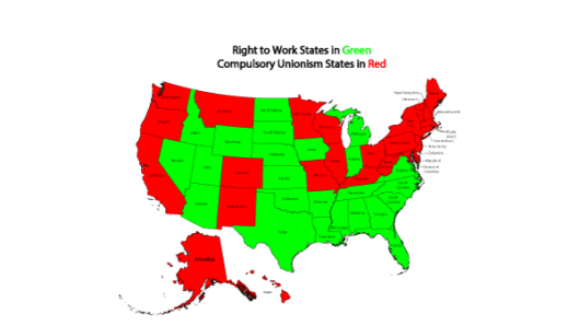

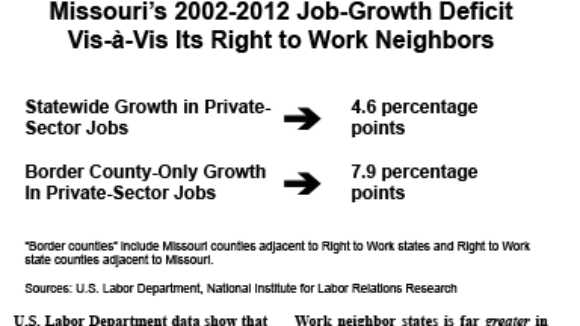

Border-County Evidence Indicates Forced Unionism’s the Culprit (click to download newsletter) This year, grass-roots proponents of making Missouri America’s 25th Right to Work state are facing off against…

Proposed Rule Would Exempt Massive Union Political Machine (click to download newsletter) Nearly 12 years ago, a coalition of voluntary organizations, including the National Right to…

According to the Indiana Department of Workforce Development, this was “the largest one-month increase in the Hoosier State on record.” The state’s November 2013 employment gains were substantial

Government Union Bosses Press State Supreme Court to Gut Act 10 (Click here to download the National Right to Work Committee’s November-December 2013 Newsletter) Government union bosses haven’t been able to overturn Wisconsin’s Act 10, which restricts their compulsory- unionism…

Pro-Forced Unionism Federal Candidates Will Have Nowhere to Hide (source: National Right To Work Committee April 2012 Newsletter) Rep. Jean Schmidt (R-Ohio) disregarded her pro-Right to Work constituents. Then voters showed her the door. Credit: Bill Clark-CQ Roll Call File Photo Federal and state disclosure reports filed by union officials and their agents show unambiguously that Big Labor controls the most massive political machine in America. In fact, just one type of report, the LM-2 forms that private-sector (and some public-sector) unions with annual revenues exceeding $250,000 are required to file with the federal government, shows that Big Labor pours over a billion dollars into politics and lobbying in every federal campaign cycle. For example, LM-2's for the years 2009 and 2010 show that unions filing such forms spent a total of $1.14 billion in forced dues-funded union treasury money on "political activities and lobbying" in the 2010 election cycle alone. A recent National Institute for Labor Relations Research analysis of data from LM-2's and other federal and state reports conservatively concluded that the union machine spent a total of $1.4 billion on federal and state politics and lobbying in 2009 and 2010. Candidate Survey Is 'One of the Committee's Most Effective Tools'

Union-label Illinois Gov. Pat Quinn has run up his state's public spending and debt to Greece-like levels. Credit: www.chicagonow.com Compulsory-Unionism Stronghold State Drowning in Taxes and Debt (source: National Right To Work Committee February 2012 Newsletter) In early 2012, as the national economy continues struggling to recover from the severe 2008-2009 national recession, many states are in financial dire straits. But Big Labor-dominated Illinois is very arguably the worst fiscal basket case of all. Early last month, Moody's Investors Service downgraded Illinois debt to A2, finding its creditworthiness to be the worst of any of the 50 states, including even government union-controlled California. In its report, Moody's specifically berated Illinois's "weak management practices." On January 22, a Chicago Tribune editorial observed: "Deadbeat Illinois owes some $8.5 billion in old bills, tax refunds, employee health insurance and interfund borrowing debts. That's roughly one-fourth the state's spending this year from its general funds." Over and above that, Illinois has "nearly $200 billion in debts and unfunded obligations." Burdened by labor policies authorizing union monopoly bargaining and forced union dues and fees in both the private and public sectors and a tax and regulatory climate that are hostile to private-sector job and income growth, the Prairie State has been in trouble for a long time. Big Labor 'Cure-All' For Rapidly Rising Government Debt: Massive Tax Hikes But Illinois's outlook grew even bleaker after union-label Democratic Gov. Pat Quinn and like-minded legislators acted in January 2011 to put the state, in the governor's words, "back on sound fiscal footing."