Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

Households in High-Cost Big Labor Strongholds ‘Get Socked Twice’

(Source: May 2015 National Right to Work Newsletter)

In late March, the nonpartisan, Washington, D.C.-based Tax Foundation announced its estimate that “Tax Freedom Day” (TFD) this year would come on April 24.

The Tax Foundation’s entire published analysis regarding TFD 2015 is available at www.taxfoundation.org — the group’s web site.

As the Tax Foundation explains, TFD is “the day when the nation as a whole has earned enough money to pay its total tax bill for the year.”

In 2015, “Americans will pay $3.3 trillion in federal taxes and $1.5 trillion in state [and local] taxes, for a total tax bill of $4.8 trillion,” or 31% of the nation’s income.

Right to Work State Residents Achieved ‘Tax Freedom’ on April 17

Not surprisingly, this burden is not borne equally by all Americans, and several factors play a significant role in determining when TFD comes for individual taxpayers and households.

The Tax Foundation highlighted two:

“The total tax burden borne by residents of different states varies considerably due to differing state tax policies and because of the progressivity of the federal tax system.”

Shortly after the Tax Foundation issued its report on TFD 2015, the National Institute for Labor Relations Research calculated average TFD’s for the 25 Right to Work states and the 25 forced-unionism states.

To derive average TFD’s for states where compulsory union dues are either permitted or banned, the Institute took aggregate state personal income data for 2014 as reported by the U.S. Commerce Department and the estimated 2015 TFD’s for the 50 states as reported by the Tax Foundation.

The Institute estimates that this year residents of forced-unionism states are forking over 32.9% of their total personal income in taxes, a 5.1% higher share than the national average, and a 12.3% higher share than the Right to Work state average.

TFD in forced-unionism states as a group didn’t come until April 30 this year, or six days later than the national average. In contrast, TFD in Right to Work states as a group came on April 17, or seven days earlier than the national average.

Lower Living Costs Are Key Part of Right to Work States’ Advantage

National Right to Work Committee Vice President Matthew Leen commented:

“TFD comes significantly earlier in Right to Work states than in forced-unionism states in part because state and local taxes typically consume a smaller share of income in jurisdictions where unionism is voluntary.

“Another advantage for Right to Work states is their lower living costs.”

As the Institute reported in March, interstate cost-of-living indices calculated by the Missouri Economic Research and Information Center show that on average forced-unionism states were 22% more expensive to live in than Right to Work states in 2014.

When cost-of-living differences are taken into account, the average disposable income per capita in Right to Work states is higher than in forced-unionism states.

However, progressive federal income taxes are levied on nominal, rather than cost of living-adjusted incomes.

Consequently, explained Mr. Leen, households in high-cost forced-unionism states like California, New York, New Jersey, Connecticut and Massachusetts “get socked twice.”

“They have to fork over more for housing, food, energy, health care, and other necessities,” Mr. Leen noted.

“And then they have to pay the same income tax rate as a household in a low-cost Right to Work state like Texas or North Carolina making the same nominal income, even though that nominal income goes much further in the Right to Work states.”

The TFD disparity, concluded Mr. Leen, is a prime example of how the forced-unionism system hurts practically everyone, and not just employees and business owners who are directly affected.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

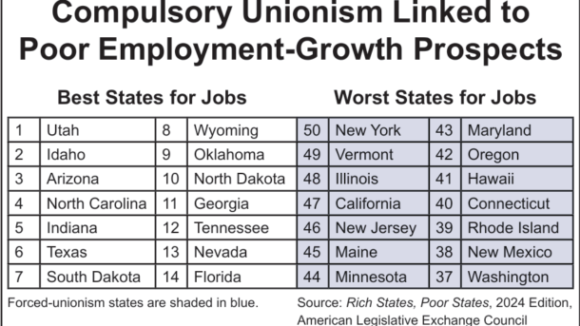

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

Members Insist They Keep Pro-Right to Work Campaign Promises