Reforms Help Teachers Ditch Unwanted Unions

The recent experiences of Florida and Arkansas show that, when government stops impeding American educators’ exit from teacher unions, many will leave them.

For many years, data from the Internal Revenue Service (IRS) have documented that states like California, New York and Illinois are paying a high price for allowing dues-hungry union bosses to get workers fired for refusing to bankroll their organizations.

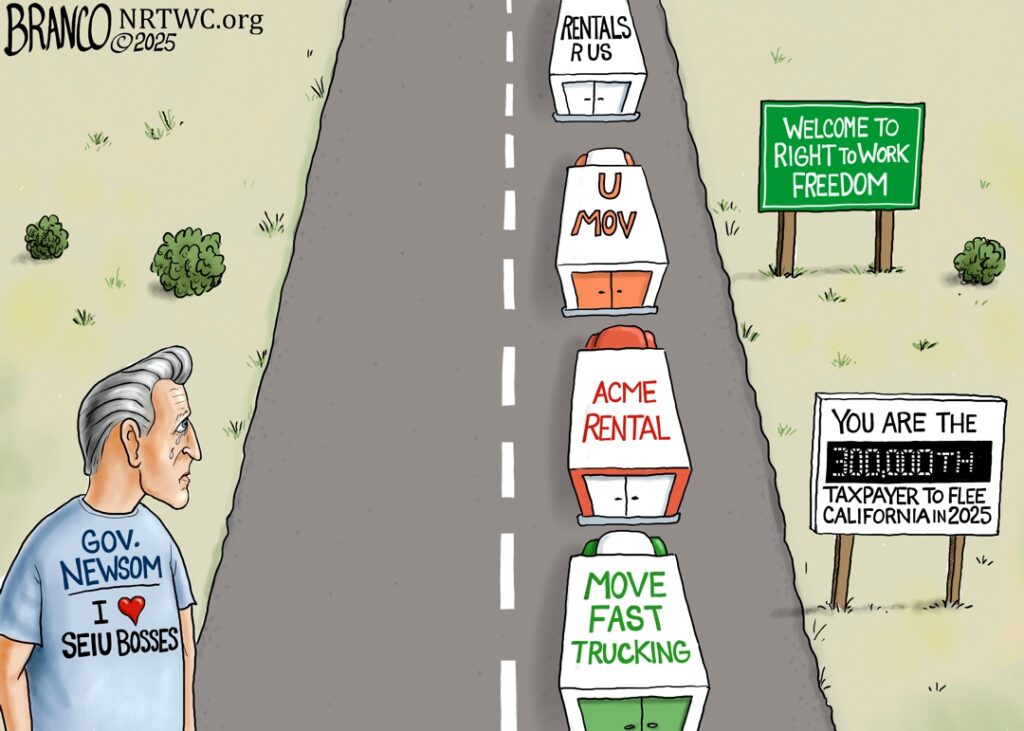

Year after year, far more taxpayers have been leaving forced-dues states than moving into them.

The cumulative losses in taxpayers and their income have been cutting into these states’ revenue bases.

But until very recently there were apparently no published estimates of exactly how much state tax revenue Big Labor states are losing each year as a consequence of their politicians’ refusal to protect employees’ Right to Work.

National Right to Work Committee President Mark Mix commented:

“Data furnished by the IRS’s Statistics of Income [SOI] division have long made it possible to calculate the sum total of wages, salaries, and other income taxpayers take with them when they move out of state.

“Personal income tax filers moving out of a forced-unionism state in 2021, the last year for which the SOI has currently published data, reported a total of $238.5 billion — or $114,122 per filer — in adjusted gross income [AGI] on the IRS forms they submitted the following year.

“Tax filers moving into a forced-unionism state reported a total of $172.7 billion in income, or $100,653 per filer.

“Both because of their substantial net taxpayer losses due to domestic migration, and because the taxpayers they gained reported $13,469 less income apiece than the taxpayers they lost, forced-unionism states lost a total of $65.7 billion in AGI in 2021 alone.”

Unfortunately, as a May 2025 National Taxpayers Union Foundation (NTUF) issue brief by policy analyst Andrew Wilford pointed out, many state executives and legislators regard the outflow of residents and their income to other states, even if it occurs year after year, as an “abstract problem.”

“State politicians are typically short-term thinkers, and consequently most worry more about the impact policies have on the total revenues available for government to spend than on the total number of people paying taxes in their state and how much income they have,” said Mr. Mix.

“But the reality is,” continued Mr. Mix, “that there is a strongly negative impact on a state’s budget when far more taxpayers are moving out than moving in, year after year, and the taxpayers who are moving out have higher incomes than those who are moving in.”

To quantify the potential negative and positive impacts of domestic migration on state revenues, Mr. Wilford drew on the aggregate state-local tax burdens as a share of income for each of the 50 states calculated by the nonpartisan Tax Foundation.

Mr. Wilford estimated that forced-dues California alone will lose roughly $4.5 billion in state-local tax revenue this year due to net out-migration of taxpayers to other states. Forced-dues states as a group will lose a projected $11.7 billion.

Of course, revenue outcomes from interstate migration “are cumulative.” As Mr. Wilford put it, “California loses $4.5 billion [in tax revenue] not just this year, but next year and every year thereafter.”

That means that, over the next decade, barring a sharp change for the better in state labor policy, forced-dues California’s cumulative, compounding losses in revenue due to taxpayers’ flying the coop could easily approach $100 billion.

“In forced-dues states, the deck is stacked against taxpayers,” observed Mr. Mix. “Union-label politicians who get elected and re-elected because of Organized Labor’s compulsory dues-funded support keep hiking taxes and foisting more red-tape regulation on businesses.

“But more and more taxpayers are refusing to be gluttons for punishment. That’s why forced-dues California, New York, Illinois, New Jersey and Massachusetts are losing more revenue due to taxpayer departures than any other states, and Right to Work Florida, Texas, North Carolina, Arizona, and South Carolina are seeing the biggest revenue gains due to taxpayer arrivals.

“Unfortunately, union boss-owned politicians like California Gov. Gavin Newsom and the other Democrat politicians who run both the state Senate and the state Assembly in Sacramento still show no sign of being ready to acknowledge reality.

“Largely as a consequence of taxpayer out-migration over the past decade, California state politicians are now looking at a $12 billion budget deficit for FY 2026. But in June, Mr. Newsom and legislative leaders agreed to a budget that basically amounts to business-as-usual in a state where general fund expenditures have already soared by more than 50% just since FY 2020.

“Sacramento politicians even decided at the last minute not to freeze the pay of unionized state government employees, despite the huge budget shortfall.

“They were apparently eager to reward California Service Employees International Union President David Huerta for getting arrested for physically blocking ICE officers from enforcing U.S. immigration law on June 6!”

While most politicians in Big Labor strongholds like California, Illinois, and New York continue to refuse to deal with the fact that forced unionism is bankrupting their states, more and more other public officials are coming to see the light on labor policy.

Thanks primarily to relentless grassroots activism by National Right to Work supporters, a total of 122 members of the U.S. House and Senate have signed on to legislation that would repeal all the current provisions in federal law that authorize forced union dues and fees as a job condition.

Mr. Mix commented: “As contemptible as California state politicians’ pandering to Big Labor is, it is federal law, not the laws of any state, that today forces millions of private-sector workers across America to fork over dues or fees to a union, whether they want to or not, as a condition of employment.

“That’s why I commend Rep. Joe Wilson [R-S.C.] and Sen. Rand Paul [RKy.] for having respectively introduced H.R.1232 and S.533, the National Right to Work Act, in the U.S. House and Senate.

“This much-needed reform would abolish from coast to coast the unfair and economically destructive coercion of workers that has now been authorized and promoted by federal labor law for nine decades.”

This article was originally published in our monthly newsletter. Go here to access previous newsletter posts.

To support our cause and help end forced unionism, go here to donate.

The recent experiences of Florida and Arkansas show that, when government stops impeding American educators’ exit from teacher unions, many will leave them.

"[Spanberger] voted twice for the so-called ‘PRO Act,’ which would have destroyed the Virginia and every other state Right to Work law, and cosponsored it one last time before stepping down to run for governor."

“Jewish teachers must allow NEA union bosses who evidently loathe them to speak for them on all matters concerning their pay, benefits, and work rules!”