Will Team Biden Weaponize Workers’ Pensions?

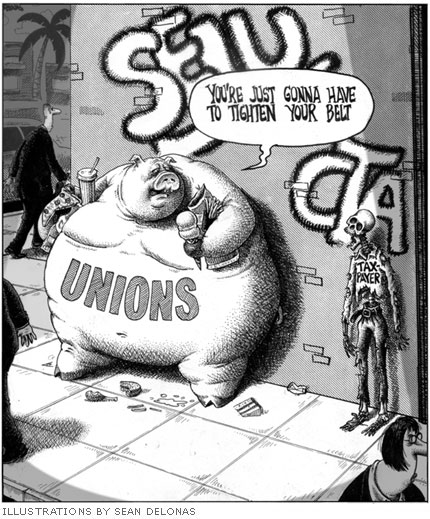

Big Labor abuse of worker pension and benefit funds as a means of advancing union bosses’ self-aggrandizing policy objectives is a familiar phenomenon.

For many years now, observers of American public policy have recognized that Big Labor bosses, and especially the bosses of government-sector unions, are our country’s most powerful lobby for Tax-and-Spend policies.

In a 2011 commentary, for example, Steven Malanga of the Manhattan Institute pointed to union officials’ expenditure of dues and fees that public employees were then forced to fork over as a job condition in more than 20 states. Union officials deployed such conscripted money, explained Mr. Malanga, “not only to run their daily operations but to wage political campaigns in state capitals and city halls.”

(Thanks to the U.S. Supreme Court’s 2018 Janus decision, forced financial support for a union as a condition of public employment is today no longer legally permissible anywhere in the U.S. Janus was argued and won on behalf of an independent-minded Illinois civil servant by National Right to Work Legal Defense Foundation staff attorney Bill Messenger.)

Mr. Malanga went on to say:

“Public-sector unions especially have become the nation’s most aggressive advocates for higher taxes and spending. . . . And they mount multimillion dollar campaigns to defeat efforts by governors and taxpayer groups to roll back taxes.”

While government union chiefs push hard for higher taxes and more public spending in all 50 states, they naturally do so with greater success in states that authorize and promote union monopoly bargaining over public workers’ terms and conditions of employment.

Well over 30 states legally require public employers, under certain conditions, to recognize a government union as the “exclusive” (monopoly) bargaining agent for their employees with regard to pay, benefits, and work rules.

Meanwhile, several states, including Arizona, Arkansas, and South Carolina, have no statewide statute or state constitutional provision forcing any category of government employer to engage in any form of bargaining with any union. And one state, North Carolina, has a statutory prohibition against any government-sector bargaining.

One rough, but useful gauge of how much coercive power union kingpins wield in any state is the share of public servants who are subject to union monopoly bargaining as reported in the Union Membership and Coverage Database. The Database was constructed by economists Barry Hirsch and David Macpherson.

By simultaneously reviewing government-union-density data for 2019 and data on state-and-local tax collections for the same year as reported by the Washington, D.C.-based Tax Foundation, one may get a grasp of just how valuable monopoly-bargaining privileges are for tax-hungry Big Labor bosses.

Among the 17 states with the highest share of public employees under union monopoly control, state and local taxes combined consumed 11.5% of all personal income in 2019.

That represents an aggregate state-and-local tax burden 22% heavier than the aggregate burden for the 16 states ranking in the middle for monopoly-bargaining density, and 31% heavier than the average for the 17 states where government union bosses wield the least coercive power over public employees.

In other words, every year, residents of government-union-stronghold states have to work nearly a week-and-a-half longer just to pay off their state-local taxes, compared to residents of states where relatively few if any public employees are forced to accept union representation in order to keep their jobs.

Eleven of the 12 states with the heaviest aggregate state-and-local tax burdens are high government-union-density states.

In stark contrast, just one of the 23 states with the heaviest overall state-local tax burdens is a low government-union-density state.

What quality services do residents of Big Labor-dominated states get in exchange for paying higher taxes?

The fact is, many workplace polices regarding employee pay, benefits, and work rules that union officials commonly advance by wielding their monopoly-bargaining privileges reduce the quality of public services even as they raise costs for beleaguered taxpayers.

One especially egregious example is the so-called “single salary schedule.”

Under this scheme, government schools “pay all teachers using a single salary formula based solely on years of work and the highest degree they obtained, not the subject in which they earned the degree,” as economist Andrew Biggs and political scientist Jason Richwine explained in a recent commentary.

Since “exclusive” union bargaining first became pervasive in public education in the late 1960’s and throughout the 1970’s, Big Labor bosses affiliated with major teacher unions have been the single salary schedule’s “most vocal proponents,” as California education analyst Julia Koppich observed in 2019.

As a consequence of the union boss-backed single salary schedule, salaries for elementary school teachers, who are typically education, liberal arts, or social science majors, are highly competitive almost everywhere in the country.

In fact, in many American communities, there is a chronic surplus of such teachers, as well as middle- and high-school teachers in fields like English, social studies, and phys-ed.

Meanwhile, in the same communities there are often chronic shortages of qualified teachers of challenging subjects like calculus, physics and chemistry as well as for special-ed and English as second language classes.

For example, in 2015, as Drs. Biggs and Richwine noted: “Connecticut public schools . . . received 167 applicants per open elementary school teaching spot, with a median applicant quality of 4.5 on a 1-to-5 scale. And yet those schools received only 17 applicants per high school science opening, with applicant quality rated just two out of five.”

National Right to Work Committee President Mark Mix commented:

“Of course, the routine failure of supply to meet demand could be remedied by what Andrew Biggs and Jason Richwine accurately describe as a ‘simple alteration to teacher pay schedules.’

“That is, STEM degree holders and teachers willing and able to educate non-English speakers and other special needs children could ‘receive a salary premium.’

“But top teacher union bosses categorically oppose such a reform, and in jurisdictions where Big Labor wields monopoly-bargaining power over how public school employees are compensated, it is unlikely to happen at all, or to be sustained if somehow it does happen.

“Consequently, in states where union monopoly bargaining in the government sector is authorized and promoted, hardworking business employees and taxpayers get the worst of both worlds.

“That is, taxes are burdensome, and public services are in many cases furnished by government employees who aren’t really qualified to do the jobs with which they are tasked.

“Of course, the relative rarity or even the absence of union monopoly bargaining over government jobs is no guarantee of sound management of public employees. But taxpayers at a minimum have a fighting chance when civil servants are union-free.”

This article was originally published in our monthly newsletter. You can go here to access previous newsletter posts.

To support our cause and help end forced unionism, you can go here to donate.

Big Labor abuse of worker pension and benefit funds as a means of advancing union bosses’ self-aggrandizing policy objectives is a familiar phenomenon.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

What impact does handing a union monopoly power to deal with your employer on matters concerning your pay, benefits, and work rules have on your pay?