Is This Any Way to Run a City’s Schools?

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

Congress Targets Taxpayer Sanctuaries From Big Labor Monopolists

As a group, taxpayers strongly believe they are worse off with the combination of taxes and public services they get in states in which more than half of public employees have a union exercising “exclusive” (monopoly) power to negotiate their wages, benefits, and working conditions.

And the compelling evidence that taxpayers prefer not to live in such government union-boss strongholds when they have a choice is furnished by the Statistical Information Service (SIS) of the IRS.

The SIS records the number of personal income tax filers who move (typically with their dependents) across state lines, based on year-to-year changes shown on individual tax returns. SIS data are arranged according to the year taxes are filed.

For example, data for the Tax Filing Year 2008 show that a total of 1.247 million personal income tax filers were residing in a high government-union-density state in 2007, but filed from somewhere else in the U.S. in 2008.

Public-Sector Union Fiefdoms Are Losing Massive Amounts Of Income as Well as People

Meanwhile, a total of 1.071 million tax filers were residing in a high government-union-density state in 2008 after residing somewhere else in the U.S. the year before.

That means, between 2007 and 2008 alone, a net total of 176,000 tax filers moved from a government union fiefdom to a state in which public-sector union bosses wield less power.

Over the last eight years for which data are available (Tax Filing Years 2001-2008), a net total of over 1.53 million tax filers moved from a state in which more than 50% of government workers were subject to union monopoly bargaining as of 2000 to a state in which government forced unionism is less pervasive.

(According to economists Barry Hirsch and David Macpherson, as of 2000 more than half of public-sector employees were unionized in 15 states: California, Connecticut, Hawaii, Maine, Massachusetts, Michigan, Minnesota, New Jersey, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Washington and Wisconsin.)

Also over the past eight years, a net total of roughly 950,000 tax filers fled to states that had public-sector unionization of less than 25% as of 2000. And a net total of roughly 580,000 fled to a state in which between 25.0% and 49.9% of public employees were under Big Labor control as of 2000.

The SIS also calculates and makes available to the public the aggregate adjusted gross incomes for households in the year immediately following their move.

While SIS data do not convey how much taxpayers who flee forced-unionism states earn any later than the first year after they depart, forced-unionism states’ losses due to domestic out-migration are clearly recurring and compounding, year after year.

Counting just the income lost by government union stronghold states in the first year after each tax filer moved out, these 15 states lost a net total of $107.9 billion (in constant 2008 dollars) due to domestic out-migration over the 2001-2008 period.

The actual total net loss, including income reported by tax filers in all years subsequent to their migration, is very likely at least four times higher, but cannot be calculated with available data.

Pending Federal Legislation Would Lead to Destruction of State Taxpayer Sanctuaries

State and local taxpayers’ ability to vote with their feet against public-sector union monopoly bargaining and other policies that promote overtaxation is gradually eroding the tax bases of government union boss-controlled states.

However, the Big Labor U.S. Congress is now poised to enact radical legislation (H.R.413/S.1611) that would lead to the imposition of union monopoly bargaining on state and local public employees nationwide — and thus leave beleaguered taxpayers with nowhere to flee.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

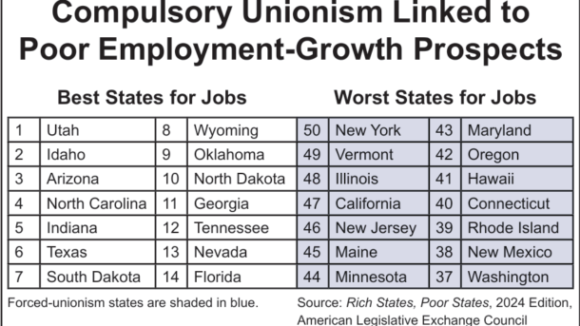

Wherever Big Labor wields the power to collect forced union dues, union bosses funnel a large share of the confiscated money into efforts to elect and reelect business-bashing politicians. Employment growth tends to lag as a consequence.

Members Insist They Keep Pro-Right to Work Campaign Promises