Will Team Biden Weaponize Workers’ Pensions?

Big Labor abuse of worker pension and benefit funds as a means of advancing union bosses’ self-aggrandizing policy objectives is a familiar phenomenon.

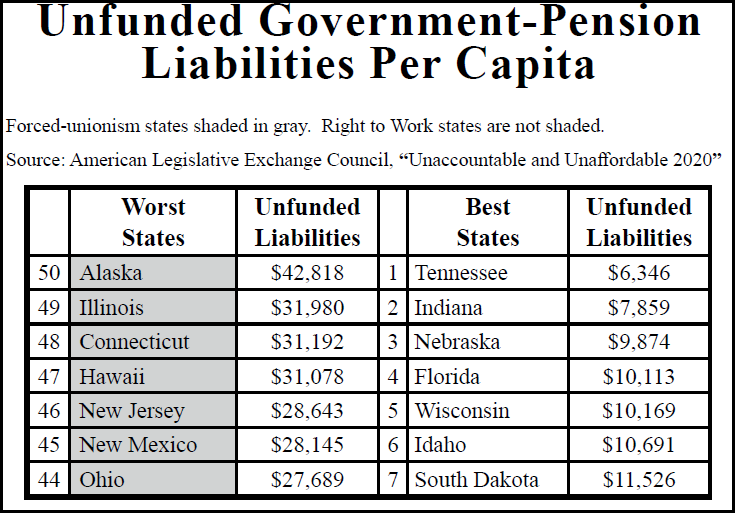

State and local pension plans suffered a steep downturn last year due to the impact of COVID-19 and lockdowns imposed by elected officials to contain its spread. But government pension underfunding is a longstanding problem. A report issued by the American Legislative Exchange Council (ALEC) in June shows that, in FY 2019, which was mostly over before the impact of COVID-19 began to be felt, “unfunded state pension liabilities” totaled $5.82 trillion nationwide.

The latest ALEC report on unfunded pension liabilities adds to the mountain of evidence that union officials endowed with monopoly privileges routinely wield them to jack up governments’ long-term spending commitments.

As a consequence of Big Labor’s back-room deals and lobbying blitzes, states that give more special privileges to union officials routinely burden their citizens with more debt as well as heavier taxation.

National Right to Work Committee Vice President Greg Mourad explained:

“According to ALEC’s current calculation, unfunded liabilities of state administered pensions, using a proper, risk-free discount rate, add up to ‘$17,748 for every man, woman and child in the United States.’

“The 23 states that have yet to adopt Right to Work laws prohibiting forced union dues and fees have an average unfunded per capita pension liability of $22,203. In contrast, the 27 states with Right to Work laws in effect have a large, but more manageable per capita pension liability that is nearly 40% lower.

“All of the seven states with the greatest per capita pension liability — Alaska, Illinois, Connecticut, Hawaii, New Jersey, New Mexico and Ohio — foist forced dues and fees on employees.”

Mr. Mourad continued:

“In contrast, all of the 15 states with the lowest per capita pension liability are Right to Work states. And four of the states with the best funded pensions — Indiana, Michigan, West Virginia and Wisconsin — approved their Right to Work laws since 2012, with the National Right to Work Committee furnishing expert advice and lobbying support in each case.”

It’s not difficult to see how Right to Work laws prevent politicians’ irresponsibility from getting completely out of hand.

In jurisdictions where forced union dues have been permitted and union monopoly bargaining in the public sector has been authorized for years, government employers negotiate exclusively with union bosses over civil servants’ pay, benefits and work rules.

Meanwhile, for many years, government union chiefs funneled a large portion of the compulsory dues and fees they collected into efforts to influence the outcomes of state and local elections.

And those outcomes have often determined who represents the public at the bargaining table.

In 2018, the U.S. Supreme Court threw out a lifeline to fiscally troubled Big Labor stronghold states with its landmark Janus decision.

Ruling in favor of independent-minded Illinois civil servant Mark Janus in a case argued and won on his behalf by Right to Work Staff Attorney William Messenger, the High Court found that extracting forced fees from public employees as a job condition violates the First Amendment.

“Janus was primarily a victory for individual rights,” said Mr. Mourad.

“Its potential impact on state budgets is also vast. Janus is giving lawmakers in state after state an opportunity to reassert control over how public employees are compensated and protect taxpayers.

“But much remains to be done, as the recent experience of Big Labor-dominated New Jersey illustrates.

“On June 29, union-label Democrat Gov. Phil Murphy signed a pork-laden FY 2022 budget that spends $46.4 billion. That’s $4.4 billion more than projected revenues, and 35% more than the state was spending when Mr. Murphy was inaugurated in January 2018.

“And this budget does effectively nothing to curtail the out-of-control growth of unfunded government pension liabilities in the Garden State, which soared by 29% over the past year for which data are available.

“New Jersey illustrates how repeal of government-sector monopoly-bargaining statutes and passage of additional state laws protecting private-sector employees’ Right to Work are indispensable parts of public budget reform.”

This article was originally published in our monthly newsletter. You can go here to access the last newsletter post, or go here to access all previous newsletter posts.

To support our cause and help end forced unionism, you can go here to donate.

Big Labor abuse of worker pension and benefit funds as a means of advancing union bosses’ self-aggrandizing policy objectives is a familiar phenomenon.

Leaked CTU Proposals Won’t Do Anything to Improve Schools’ Poor Performance

What impact does handing a union monopoly power to deal with your employer on matters concerning your pay, benefits, and work rules have on your pay?